Gen Z Owners in Mexico Report Most Vehicle Issues; Hybrids Outperform ICE Vehicles, JD Power Finds

Mercedes-Benz Ranks Highest among Premium Brands for Third Consecutive Year; Peugeot Ranks Highest among Mass Market Brands

MEXICO CITY: 7 Nov. 2025 — Vehicle owners in Mexico report an average of 229 problems per 100 vehicles (PP100), according to the JD Power 2025 Mexico Vehicle Dependability StudySM (VDS), released today. The study highlights notable differences across generations, vehicle origins, and powertrain types. Gen Z1 owners report the highest number of problems, while hybrid vehicles demonstrate the strongest performance in dependability, particularly in areas such as driving experience and powertrain.

Now in its 11th year, the study measures problems by original owners of vehicles in Mexico after 12-36 months of ownership. The study examines 184 specific problem areas across nine major vehicle categories: exterior; driving experience; features/controls/displays (FCD); driving assistance; infotainment; seats; climate; interior; and powertrain. Overall dependability is determined by the number of problems experienced per 100 vehicles, with a lower score reflecting higher quality.

“While the top problems vary by generation, Gen Z customers expect more from their vehicle in terms of technology, as the top issue among this age group is a lack of power plugs/USB ports in the vehicle,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “Another key finding is that hybrid vehicles continue to stand out among other powertrain types for lower problems experienced in key areas such as driving experience and powertrain, helping to fuel growing consumer interest and demand for the technology.”

Following are some key findings of the 2025 study:

- Gen Z owners more vocal: Nearly three-fourths (72%) of Gen Z customers say they have experienced at least one problem with their vehicle, the highest proportion of any generational group. Problems among Gen Z owners have climbed to a record high of 307 PP100 and is the only generational group to experience problems above the industry average of 229 PP100.

- More problems with Chinese- and U.S.-made vehicles: Owners of vehicles manufactured in China and the U.S. experience the highest number of problems (251 PP100 and 249 PP100, respectively). In contrast, vehicles built in Japan have the fewest problems. Notably, Asian brands—especially those from China and Japan—continue to have higher numbers of infotainment-related problems, highlighting technology performance as a key area for improvement. Chinese brands also have lower loyalty rates, with only 32% of customers indicating they would repurchase the same brand.

- Hybrids outperform ICE vehicles: Hybrid vehicles continue to attract strong consumer interest, while the industry still faces challenges in improving consumer understanding of fully electric vehicles and the steps needed to support broader adoption. Compared with other powertrain types, hybrids show better performance across a variety of key metrics, including the lowest PP100 at 196 and the highest share of repurchase intent among customers (60%). In contrast, internal combustion engine (ICE) vehicles lag with more problems (229 PP100) and weaker repurchase intent (47%).

Highest-Rankings Brands

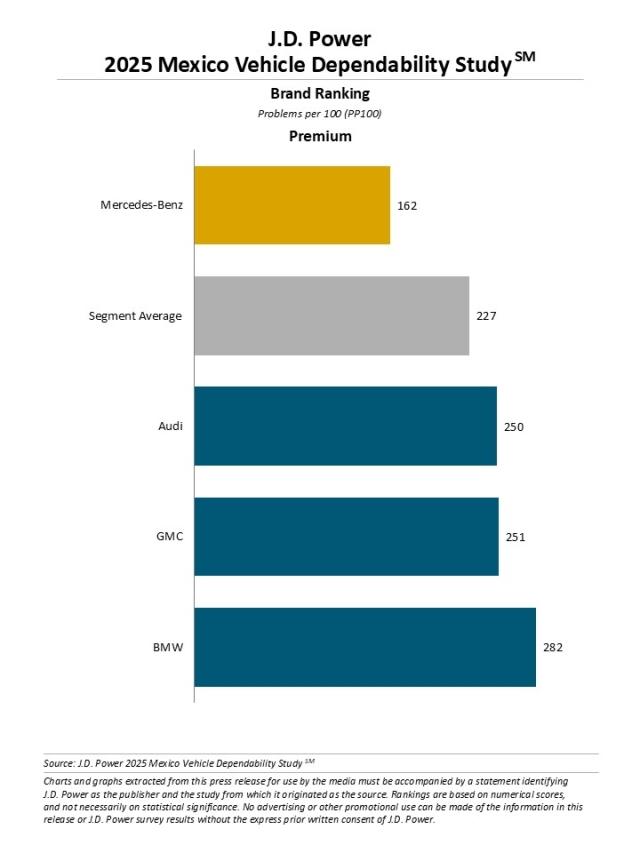

Mercedes-Benz ranks highest in vehicle dependability among premium brands for a third consecutive year, with a score of 162 PP100. The segment average is 227 PP100.

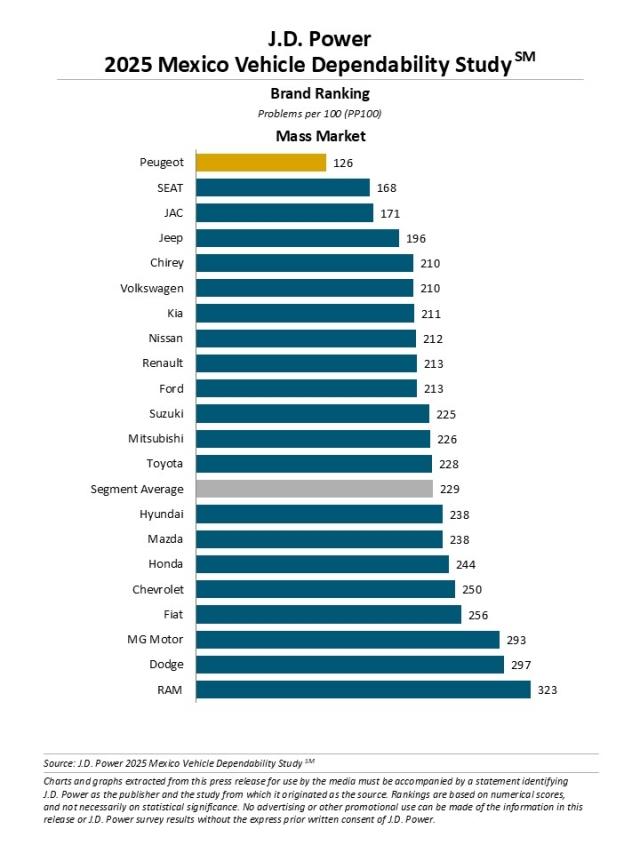

Peugeot ranks highest in vehicle dependability among mass market brands with 126 PP100. SEAT ranks second (168 PP100) and JAC (171 PP100) ranks third.

Segment Awards

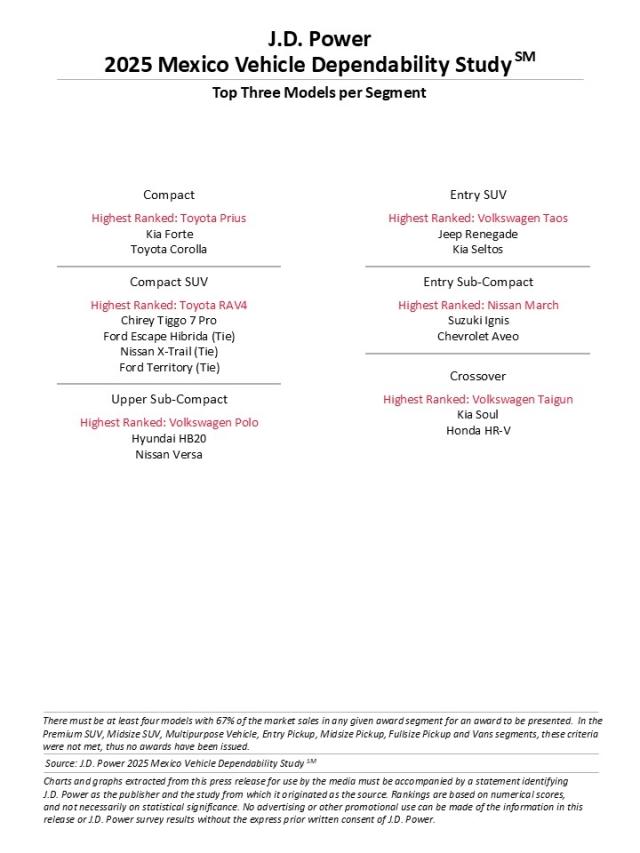

Listed below are the highest-ranked models in each segment.

Entry Sub-Compact: Nissan March

Upper Sub-Compact: Volkswagen Polo

Compact: Toyota Prius

Entry SUV: Volkswagen Taos

Crossover: Volkswagen Taigun

Compact SUV: Toyota RAV4

The 2025 Mexico Vehicle Dependability Study is based on responses from 9,027 original owners of 2022 to 2024 model-year vehicles. The study was fielded from November 2024 through August 2025.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran, Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Joe LaMuraglia, JD Power; East Coast; +1 714-621-6224; media.relations@jdpa.com

1JD Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.