Owners of Alternative Powertrain Vehicles Have Higher Sales Satisfaction in Mexico, JD Power Finds

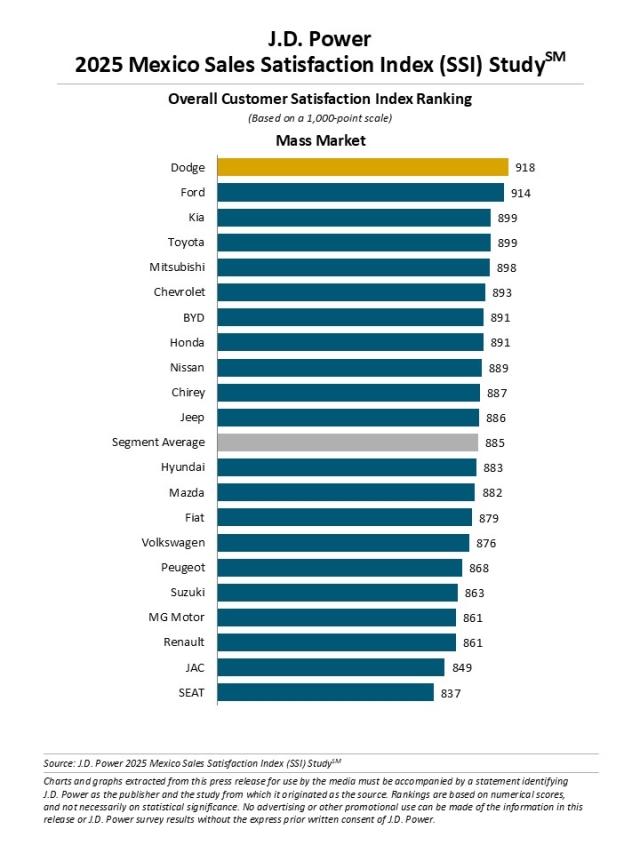

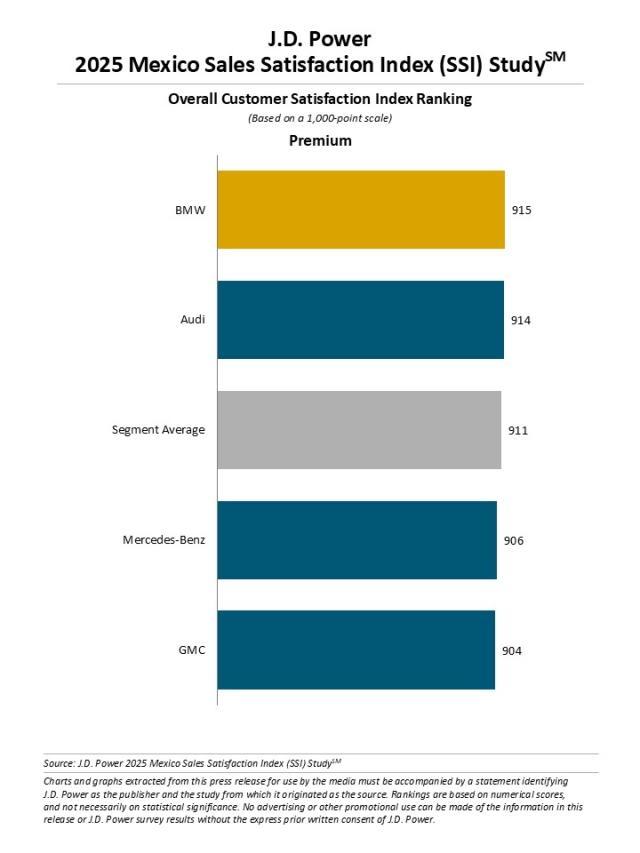

Dodge Ranks Highest in Sales Satisfaction Overall; BMW Ranks Highest in Premium Segment

MEXICO CITY: 27 March 2025 — While alternative powertrain vehicles are not gaining market share quickly in Mexico, satisfaction among buyers of battery electric vehicles (BEVs), hybrids and plug-in electric vehicles (PHEVs) is higher than among buyers of gas-powered vehicles, according to the JD Power 2025 Mexico Sales Satisfaction Index (SSI) Study,SM released today. Satisfaction among owners of hybrids (909 on a 1,000-point scale), PHEVs (902) and BEVs (892) exceeds that gas-powered vehicle owners (885).

Also, new-vehicle buyers in both the premium and mass market segments in Mexico express lower satisfaction with dealer facilities, highlighting the need for brands to prioritize the quality of the products they offer at dealerships. Overall sales satisfaction in the premium segment is 911 and in the mass market segment it is 885. The two largest gaps in satisfaction are in facility (+44 points) and brand website (+26), with premium buyers having higher satisfaction in both areas.

“Visiting a dealership remains a critical part of the car-buying journey, as nearly all shoppers make such a visit,” said Gerardo Gomez, senior director and country manager at JD Power Mexico. “In order to bring more customers into the fold, brands should particularly focus on improving the quality of amenities offered at the dealership, such as complimentary beverages and wireless internet access. This is especially true for Chinese brands, for which shoppers have lower satisfaction with dealer activities like the test drive and have a lower level of trust in the dealership.”

Offering a satisfactory sales experience is perhaps most imperative for Chinese brands, which continue to permeate the new-vehicle market in Mexico and pique shopper interest. This year’s study includes data from seven Chinese brands, which is more than ever before. However, 34% of buyers say they avoid Chinese brands due to reliability, brand reputation and ratings/reviews.

Following are some key findings of the 2025 study:

- Gen Z1 buyers need more education and simpler explanations about leasing: A knowledge gap exists among Gen Z buyers when it comes to leasing, with 15% being unaware of what leasing is and 13% finding it too complicated to understand. “Concerns about ownership are common among younger buyers, as a number of them view leasing as expensive,” Gomez said. “This presents an opportunity for dealers to better inform Gen Z buyers about leasing options. Addressing such issues could improve leasing business.”

- Customers least satisfied with dealer facilities: Dealer facilities rank lowest in satisfaction among both premium (899) and mass market (855) customers, indicating an opportunity to improve dealership experiences. The most significant difference is in the quality of amenities offered, such as a children’s play area and complimentary beverages. This suggests that premium dealerships offer noticeably better customer comforts—a clear opportunity for mass market brands to improve. When no amenities are offered, satisfaction among mass market customers drops significantly (-98 points) from premium customers, showing the importance of investing in this process.

- Untapped potential with smartphone apps: Encouraging smartphone app adoption can be a strategic move for brands, as the positive correlation between app usage and satisfaction suggests that apps boost the user experience, especially for tech-heavy vehicles. Among those who say they use a brand’s app “more than half of the time,” satisfaction is 909 compared with 859 among those who have never used it. However, while app usage increases among younger generations, there’s still hesitation, even among Gen Z, indicating potential barriers like app complexity or limited perceived value. Gen X (41%) and Gen Y (37%) show higher engagement, whereas 35% of Gen Z customers use the app more than half of the time.

- Gen Z customers most satisfied with—and most trusting of—dealers: Among all generations, Gen Z customers have the highest overall sales satisfaction (899), followed by Gen Y (886) and Boomers (886). Gen Z is also the most trusting generational cohort (642 on a 700-point scale), as they have the least amount of experience buying a vehicle, so it is natural for them to trust the dealership more. Conversely, Gen X customers trust dealerships the least (618), particularly when it comes to putting the interests of customers first and being easy to do business with.

Study Rankings

BMW ranks highest among premium brands with a score of 915. Audi (914) ranks second.

Dodge ranks highest overall and among mass market brands with a score of 918. Ford (914) ranks second, while Kia (899) and Toyota (899) each rank third in a tie.

The Mexico Sales Satisfaction Index (SSI) Study, now in its 12th year, provides automotive manufacturers and consumers with an objective measure of the satisfaction levels of new-vehicle buyers. The study emphasizes the relevance of the online vehicle shopping experience and examines customer satisfaction with the selling dealer across six measures (listed in order of importance): dealer personnel (28%); delivery process (21%); facility (20%); working out the deal (12%); paperwork (13%); and brand website (5%).

The study is based on evaluations of new-vehicle buyers in Mexico considering 2023-2025 models, after one to 12 months of ownership. The study was fielded September 2024 through February 2025.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, JD Power; West Coast; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

1JD Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.