Customer Service Satisfaction Hits Record Levels in Mexico as Pandemic Fades, JD Power Finds

Toyota Ranks Highest in Long-Term Service Satisfaction

MEXICO CITY: 19 July 2022 — Both franchised dealer and non-dealer auto service providers are delivering better customer service than ever, and dealer service continues to outperform that of non-dealers. At the same time, according to JD Power 2022 Mexico Customer Service Index—Long-Term (CSI-LT) Study,SM released today, the relative lack of customer loyalty with dealer service offers non-dealer service providers some opportunity for gains.

With the COVID-19 pandemic on the wane, the number of service visits has increased to near pre-pandemic levels. Dealers now have 55% of total service spend vs. 45% for non-dealer facilities, which includes both franchise service providers and independent shops. A driving force is the fact that the spend-per-visit at dealer facilities is higher ($3,463) than at non-dealer facilities ($2,432). Both dealer and non-dealer service facilities can take simple, inexpensive steps to push customer satisfaction still higher.

“The service business was hard hit by the pandemic, but both authorized dealers and independent service shops have seen visits and revenue-per-visit increase,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “While satisfaction maintains a steady upward trend, service providers must not let higher revenues prompt them to lose sight of the importance of satisfying their customers.”

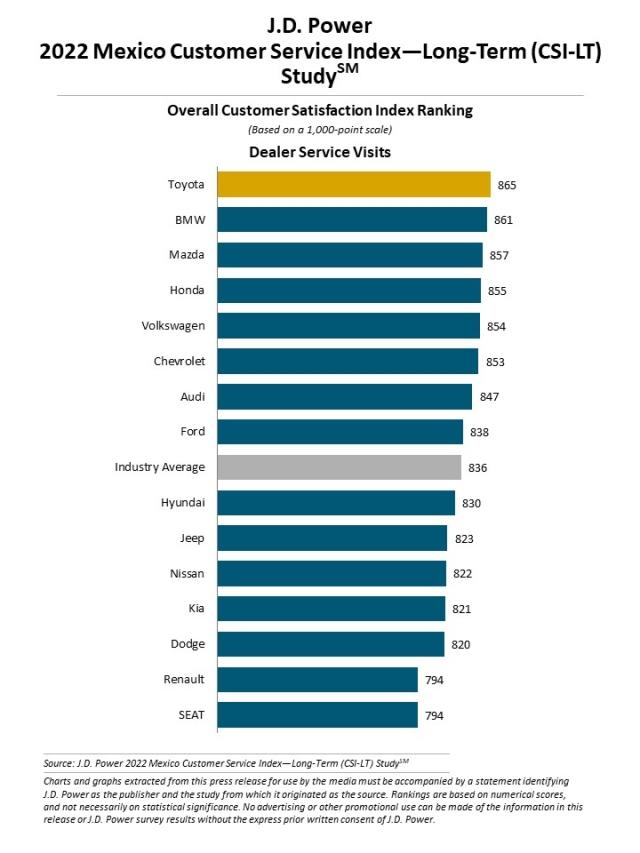

Now in its fourth year, the study provides a comprehensive analysis of the service experience among owners of three- to 12-year-old vehicles. It evaluates customer satisfaction with their dealer or non-dealer service center by examining five key measures (in order of importance): service quality (27%); service advisor (22%); service initiation (19%); service facility (17%); and vehicle pick-up (15%). Satisfaction is calculated on a 1,000-point scale.

Both dealer and non-dealer service operations register record levels of customer satisfaction in this year’s study. While non-dealer shops closed the gap in service satisfaction with dealer operations in 2021, the gap has widened by 3 points in 2022. Overall satisfaction is 836 among customers who have their vehicle serviced at a dealer vs. 801 among those who use non-dealer facilities.

Though dealers capture most of the total Mexican auto service business, non-dealer facilities generate more service visits (54% non-dealer service visits vs. 46% dealer visits). Dealer facilities have seen a substantial improvement to 1.6 visits from 1.1 in 2021, while the uptick in non-dealer visits has risen to 1.8 from 1.6 visits a year ago. Non-dealer service visits have not recovered to the 2020 level of 2.0 visits. The average service spend per visit at dealer facilities is 42% higher this year than at franchises and independent garages. In 2021 the average service spend at a dealer was 46% higher than at non-dealer facilities.

Following are some key findings of the 2022 study:

- Service advisors key to delivering improved satisfaction: The attentiveness and helpfulness of individual service advisors is a big driver of customer satisfaction with the service experience. For example, satisfaction is 851 among customers who say the service advisor was focused on them and their needs, while satisfaction is 678 among those who say their service advisor was not focused on them and their needs. Customers expect service advisors to provide helpful advice, and they want to be informed of the status of the service.

- Satisfaction can be improved with minimal investment: Providing simple services can help dealers improve customer satisfaction without investing in equipment. Providing a service appointment on the desired day has a big effect on satisfaction. When a customer can get an appointment on the day they want, satisfaction improves 82 points. Actions concerning vehicle pick-up after the service has been completed are also important. When dealers provide services such as calling the customer to notify them that their vehicle is ready, satisfaction improves 36 points.

- Lack of loyalty to dealer facilities gives independents hope: One of every two owners who took their model-year 2010 to 2019 vehicle for service in the past year switched between dealer facilities and independent service providers. This is almost double the rate of a year ago. Just 18% of service customers say they are fully loyal to dealer service providers, while 32% of customers say they are fully loyal to independent providers. If independents can increase the number of visits and spend by vehicle owners who frequent both dealer and independent shops, they can increase their business and narrow the gap with dealers.

- Dealers charge more yet deliver more satisfaction: The price of maintenance work performed by dealer facilities is 50% more than similar work provided by non-dealer facilities. Since vehicle owners consider price to be the main barrier to visiting dealer facilities, dealers might reconsider their pricing strategies to conquest more customers. Overall, dealers are delivering a better service experience compared with independent service facilities for both repairs and maintenance.

Highest-Ranking Brands

Toyota ranks highest in overall satisfaction among franchised dealers with a score of 865. BMW (861) ranks second and Mazda (857) ranks third.

The 2022 Mexico Customer Service Index—Long-Term (CSI-LT) Study is based on the evaluations of 3,422 interviews with new- and used-vehicle owners in Mexico about their three- to 12-year-old vehicles. The study was fielded from March through May 2022.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info