Respect of Customers’ Time Affects Satisfaction with Dealership Service, JD Power Finds

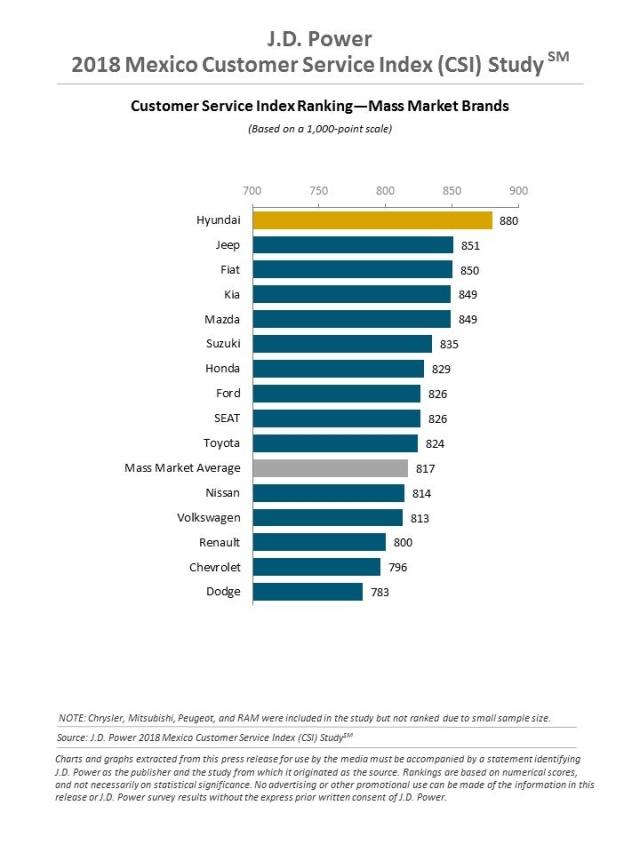

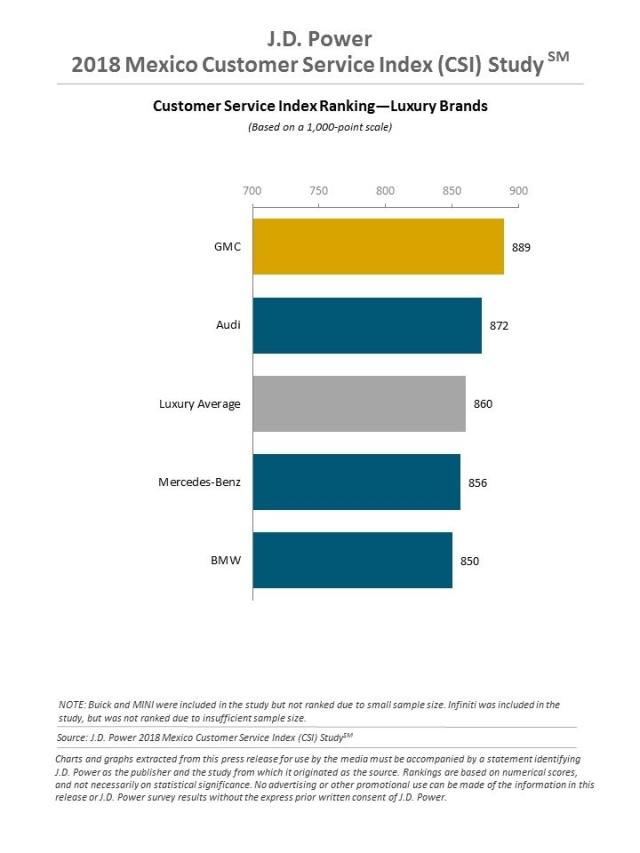

Hyundai Ranks Highest among Mass Market Brands; GMC Ranks Highest among Luxury Brands

MEXICO CITY: 19 Oct. 2018 — Respect my time. That overarching message comes across often when owners bring their vehicles to be serviced at a dealership, according to the JD Power 2018 Mexico Customer Service Index (CSI) Study.SM When dealers give customers an appointment on a desired day, have vehicles ready when promised and greet customers promptly, satisfaction is generally higher.

An additional metric for dealers to consider is the Net Promoter Score® (NPS)[1]—new to this year’s study—which measures customers’ likelihood to recommend both their vehicle make and model on a 0-10 scale. Customers are segmented into three groups: detractor (0-6), passive (7-8) or promoter (9-10). The NPS is calculated by subtracting the percentage of detractors from the percentage of promoters. For example, the NPS for the mass market segment in this year’s study is 75 (78% promoters minus 3% detractors).

“The Net Promoter Score is higher in Mexico for both luxury and mass market segments than in any other global market,” said Gerardo Gomez, Senior Director and Country Manager at JD Power de Mexico. “Promoters are far more likely to be loyal to a brand. In fact, there’s a strong link between the NPS and the traditional JD Power customer satisfaction score. Overall satisfaction among promoters of their vehicle’s make is 144 points higher than among detractors. Dealers looking to generate return sales and service business need to ensure they’re taking steps to explain the work done and the charges and to fix collision work and maintenance issues right the first time.

“This is especially evident among Boomers,[2] who are more likely to choose a dealer based on experience with the service and sales departments than younger customers because the older generation has had more time to develop a loyal relationship with a dealer over the course of more purchase cycles in their lifetime. Younger customers are less likely to have a dealer to whom they are loyal for service and are far more likely to rely on recommendations from friends and relatives.”

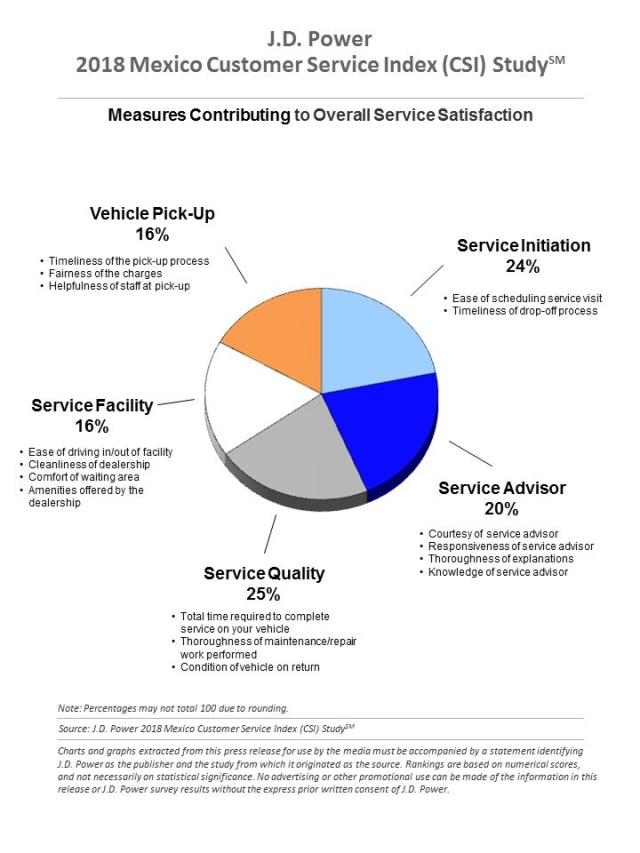

The Mexico CSI Study, now in its fourth year, delivers a comprehensive analysis of the service experience among owners of 1- to 3-year-old vehicles and evaluates customer satisfaction with their servicing dealer by examining five key measures (in order of importance): service quality (25%); service initiation (24%); service advisor (20%); vehicle pick-up (16%); and service facility (16%). Satisfaction is calculated on a 1,000-point scale.

The study finds that 91% of customers were able to get an appointment on their desired day; 87% of customers’ vehicles were ready when promised; 42% spoke with a service advisor within two minutes of arrival; and 47% were informed within 290 minutes or less after dropping their vehicle off that their car was ready for pick-up.

Following are some key findings of the 2018 study:

- Phone calls preferred, but messaging apps on the rise: While more customers in Mexico prefer to communicate via messaging app year over year—increasing to 27% in 2018 from 24% in 2017—only 4% indicate their advisor communicated with them via messaging app, making this an unmet preference for a significant number of customers. Mexico is the only global market in which the preference for phone calls has increased from 2017, but dealers should also begin embracing messaging apps to accommodate the desires of customers.

- Service quality and initiation are largest problems for collision work: Service satisfaction is significantly higher among customers who did not have collision work done compared with customers who did have collision work done. The largest gaps are in the service quality (98 points) and service initiation (91 points) measures. The study finds that collision work is completed right the first time far less often than service work that does not include collision work. Improving fixed-right-first-time percentages for collision work is the most important priority for improving satisfaction with this type of work.

- Competition between dealers and non-dealers increases with vehicle age: Dealers should be aware that it is very important to focus on providing an excellent servicing experience to customers with older vehicles, so they don’t lose visits to non-dealer service providers as vehicles age.

“The average number of service visits per year to a non-dealer more than doubles between 1-year-old and 3-year-old vehicles, from 0.2 visits per year to 0.5 visits per year,” Gomez said. “While nominally a small number, this means dealers capture 91% of service visits for 1-year-old vehicles, but only 81% of service visits for 3-year-old vehicles. Once vehicles come out of warranty, service work becomes more complex, and it’s imperative for customers to trust their dealers about the work to be done—and the associated cost—when they take their car in for service. This can help build a lasting relationship when it comes time for customers to purchase a new vehicle.”

Highest-Ranking Brands

Hyundai ranks highest in overall satisfaction among mass market brands, with a score of 880. Jeep ranks second (851) and Fiat (850) ranks third. Kia and Mazda rank fourth in a tie with a score of 849.

GMC ranks highest among luxury brands for the first time, with a score of 889. Coming on the heels of its top ranking in the JD Power 2018 Mexico Sales Satisfaction Index (SSI) Study.SM Audi ranks second (872) and Mercedes-Benz (856) ranks third.

The 2018 Mexico Customer Service Index Study is based on the evaluations of 6,921 interviews with new-vehicle owners in Mexico approximately 12 to 36 months after purchase. The study was fielded from April through August 2018.

Media Relations Contacts

Brais Alvarez; Mexico City; +52 55 5081 2892 / +52 1 55 7474 4074; brais.alvarez@jdpa.com

Silvia Mosqueda; Mexico City; +52 1 55 5368 2177; smosqueda@sintralogistics.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

JD Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. JD Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

About JD Power and Advertising/Promotional Rules https://www.jdpower.com/business/about-us/press-release-info

[1] Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

[2] JD Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004).