“Back to Basics” Sales Approach Can Help Combat Declining New-Vehicle Sales, JD Power Finds

BMW and Honda Rank Highest in Respective Segments for New-Vehicle Sales Satisfaction in Mexico

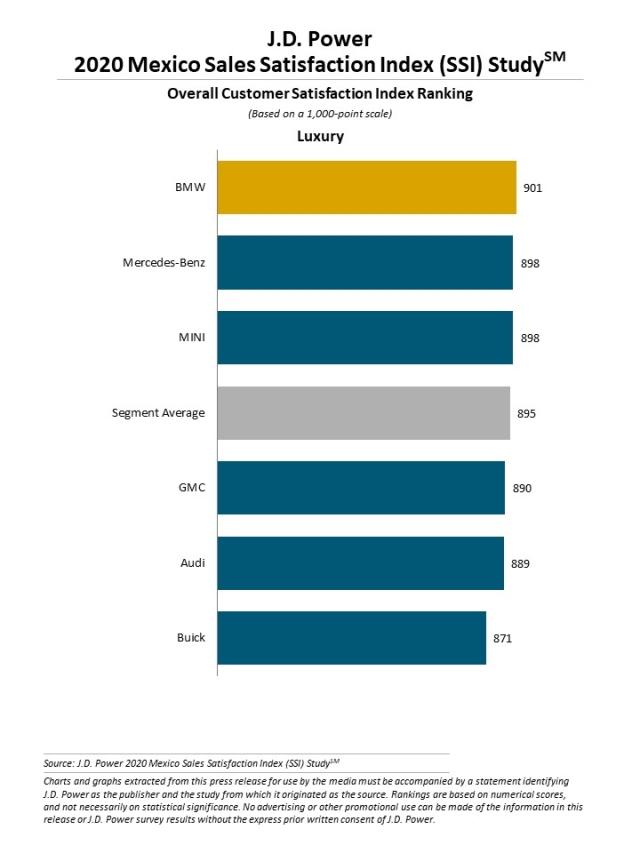

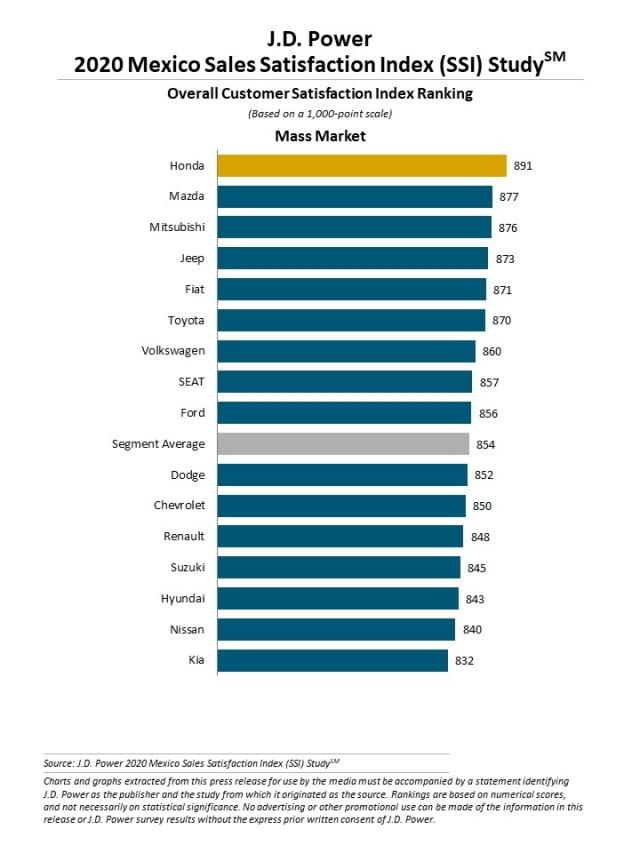

MEXICO CITY: 27 March 2020 — Low consumer confidence is putting pressure on auto dealers to provide a more satisfying vehicle sales experience, according to the JD Power 2020 Mexico Sales Satisfaction Index (SSI) Study,SM released today. Luxury brand dealers are successfully addressing consumers’ wants and needs and have eclipsed mass market brand dealers in overall sales satisfaction. In the luxury segment, satisfaction improves to 895 (on a 1,000-point scale), which is 17 points higher than in 2019. The mass market segment remains flat at 854.

“New-vehicle sales in Mexico are expected to decrease by 3.2% to 1.27 million units in 2020, and that alone should inspire dealers to be more focused on satisfying—and keeping—customers than ever before,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “Buyers value the basic steps in the sales process, such as test drives and developing a personal connection with a salesperson. Dealers that recognize and act on what makes buyers satisfied will capture more sales.

“Something as simple as ensuring a customer is immediately greeted by a salesperson can improve satisfaction by 37 points,” Gomez said, “but this only happens 88% of the time. Dealers must take advantage of every opportunity to set themselves apart from the competition, and they must realize that not every sales initiative is a costly one.”

The study, now in its seventh year, is a comprehensive analysis of the new-vehicle purchase and delivery experience. It examines customer satisfaction with the selling dealer across five measures (in order of importance): vehicle delivery (26%); working out the deal (24%); salesperson (19%); dealership facility (18%); and test drive (14%).

Luxury brand satisfaction improves across all categories, led by salesperson (+22 points); vehicle delivery (+22 points); and working out the deal (+18 points). Mass market brand satisfaction remains virtually unchanged from 2019.

Following are key findings of the 2020 study:

- Fuel efficiency stands out among purchase considerations: The continuing increase in fuel prices in recent years has driven more mass market shoppers to purchase the most fuel-efficient models available in the marketplace. Among attributes measured in the study, new-vehicle buyers say that higher fuel economy is most important (14.1%).

- Internet can be doubled-edged sword for new-vehicle shopping: The majority (87%) of new-vehicle shoppers use the internet during their shopping process. However, satisfaction is 19 points higher when shoppers don’t use the internet to shop for a vehicle. Dealers must ensure the information that’s provided on their websites is clear, true and consistent with what shoppers will find on the lot to avoid setting false expectations. For example, prices and promotions that are in small print on a dealer website, and therefore may be overlooked by shoppers, may have a negative effect on satisfaction once a shopper becomes aware of them when they visit the dealership.

- Optimize vehicle delivery process: On average, answering all owner’s questions during delivery results in higher satisfaction (864) than when not being able to answer questions (610). When personally thanked for their purchase, owners have a satisfaction score of 864. On the other end of the spectrum, satisfaction is only 800 when a vehicle isn’t delivered with a reasonable amount of fuel, which occurs 24% of the time. Contacting the owner after the vehicle is delivered to ensure everything was satisfactory is another area where dealers can improve. This only happens 68% of the time, accounting for an 11-point decrease in satisfaction.

- Buyer-selected insurance increases satisfaction: Sales experience satisfaction is higher when new-vehicle buyers are given the opportunity to select their own insurance company than among those who had an insurance company imposed on them by the dealer at the time of purchase. Of the buyers who paid in cash for their new vehicle, 71% selected their own insurance company, having a satisfaction score of 879. Among buyers who paid in cash but had the insurer imposed on them by the dealer, satisfaction was 851.

- Buyers who paid in cash for their vehicle are more satisfied: Satisfaction is 26 points higher among buyers who paid cash than among those who requested a loan. This presents an opportunity for dealers to improve their negotiation and financing processes, especially since buyers requesting loans represent 65% of their sales.

Study Rankings

BMW ranks highest among luxury brands, with a score of 901, a 20-point increase from 2019. Mercedes-Benz and MINI rank second in a tie, each with a score of 898.

Honda ranks highest among mass market brands, with a score of 891, which is 42 points higher than in 2019. Mazda (877) ranks second and Mitsubishi (876) ranks third.

The 2020 Mexico Sales Satisfaction Index (SSI) Study is based on evaluations of 3,403 new-vehicle buyers in Mexico after one to 12 months of ownership. The study was fielded from September 2019 through February 2020.

For more information about the Mexico Sales Satisfaction Index (SSI) Study, visit https://mexico.jdpower.com/es/resource/mexico-sales-satisfaction-index-ssi-mx

JD Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contacts

Fabiana Duran; Mexico City +52 55 1012 0885; fabianaduranp@gmail.com

Silvia Mosqueda; Mexico City; +52 55 5368 2177; smosqueda@sintralogistics.com

Omar Pellon; Mexico City; +52 55 7940 9174; omar.pellon@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info