Vehicle Service Satisfaction in Mexico Declines Following Pandemic, JD Power Finds

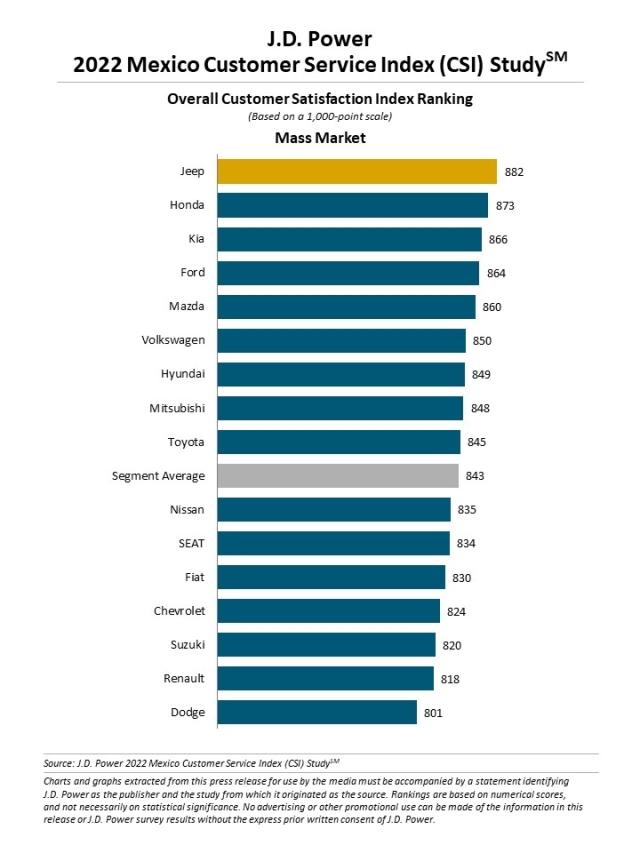

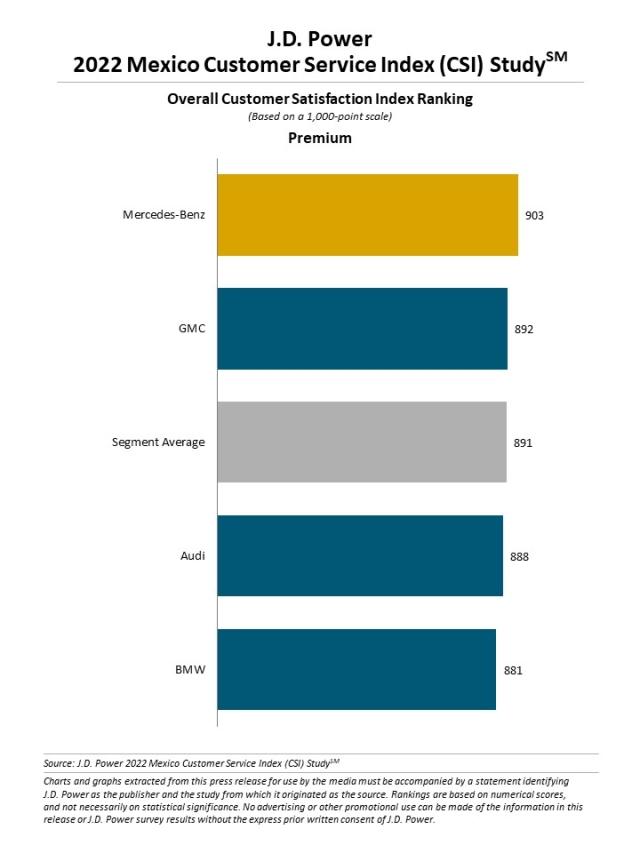

Jeep and Mercedes-Benz Rank Highest in Respective Segments

MEXICO CITY: 27 Sept. 2022 — Customer service satisfaction with automotive dealers declines this year in the aftermath of the pandemic, according to the JD Power 2022 Mexico Customer Service Index (CSI) Study,SM released today. Overall satisfaction decreases to 845 (on a 1,000-point scale) from a record high of 850 a year ago, marking the first decline after four consecutive years of increasing satisfaction.

The study shows that inflation also may be a reason for the slight decline in customer service satisfaction. One indicator that while the average number of service visits to dealers has increased to 2.27 from 2.14 in 2021, the total number of service visits to dealers declined 16% and the amount spent on service—15,161 million Mexican pesos—is down just 8% year over year. Service visits for one- to three-year-old vehicles are down 16% in large part because there are 21% one- to three-year-old vehicles than a year ago, the result of the pandemic on new-vehicle sales during the past two years.

Study results show quite clearly that, even in this digital age, customers want a personal touch. The study examines nine different types of interactions between dealership service personnel and customers, and it finds that more personal interactions result in higher levels of satisfaction than when those interactions are absent. When the service advisor completes all nine interactions measured, customer service satisfaction with the service advisor is 270 index points higher than when just three or fewer interactions take place.

“The study points out the critical importance of paying attention to the customer,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “When service advisors complete all nine of the measured interactions with customers, only 3% of customers say they are not likely to return to that dealership. But when just zero to three interactions take place, that percentage jumps to 14% of those who say the same. Clearly, interaction is key to loyalty and customer retention.”

Customers also appreciate getting accurate price estimates prior to having service work performed. Vehicle owners indicate that the price estimates are accurate most of the time (92% at premium-brand dealerships and 91% at mass market-brand dealerships). But, among the 5% of customers whose actual cost of service is higher than the estimate, satisfaction plummets 105 points.

Now in its seventh year, the study is a comprehensive analysis of the service experience among owners of one- to three-year-old vehicles and evaluates customer satisfaction with their authorized dealer by examining five key measures (in order of importance): service quality (25%); service advisor (21%); vehicle pick-up (19%); service facility (17%); and service initiation (16%).

Following are some key findings of the 2022 study:

- Service customers want explanations: When customers come in to pick up a vehicle that has been serviced, they expect to see detailed charges. Service satisfaction is higher by almost 100 points when charges are explained than when they are not. It’s notable that 88% of premium-brand customers say they received a detailed explanation of charges, compared with 72% among customers of mass market brands.

- Amenities mean something to customers: In addition to appreciating personal interaction, customers also favor dealerships that offer amenities such as wireless internet access and complimentary snacks and coffee. Customer service satisfaction with dealerships that fail to offer amenities is 106 points lower than for those dealers who do. Interestingly, complimentary snacks are accessed by the same percentage of customers who stayed at the dealership for the duration of the service vs. those who exited and returned to pick up their vehicle.

- Customers want it on their own time: The most influential indicator of customer service satisfaction is whether the customer can book a service appointment on the day they desire. If booked on the desired day, satisfaction increases 72 points. The vehicle was ready when originally promised 89% of the time, which can lead to an increase in satisfaction of 59 points. More than two-thirds (68%) of the time, it takes less than 18 minutes to complete paperwork when a vehicle is being delivered to the customer. However, if completion of paperwork takes more than 18 minutes, satisfaction drops 17 points.

- Satisfaction varies by type of work being performed: Customers say they are more satisfied with some types of service work than others. Service to audio/entertainment systems improves 33 points from a year ago (870 vs. 837, respectively), but satisfaction declines for work in other categories such as heating/ventilation/air conditioning; transmission; electrical; and battery replacement. These declines may reflect supply-chain issues that continue to plague the industry.

Highest-Ranking Brands

Jeep ranks highest in the mass market segment with a score of 882. Honda (873) ranks second and Kia (866) third.

Mercedes-Benz ranks highest in the premium segment with a score of 903. GMC (892) ranks second.

The 2022 Mexico Customer Service Index (CSI) Study is based on the evaluations of 5,429 new-vehicle owners of 2019, 2020 or 2021 model-year vehicles who took their car for service in the past 12 months to an authorized dealer facility. The study was fielded from March through August 2022.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info