Customer Service Satisfaction Improves in Mexico Despite Pandemic, JD Power Finds

Mazda Ranks Highest in Long-Term Service Satisfaction

The COVID-19 pandemic affected the number of service visits made by vehicle owners, reducing visits to dealer and non-dealer facilities. According to the JD Power 2021 Mexico Customer Service Index—Long-Term (CSI-LT) Study,SM released today, customers found those visits more satisfying despite the decline in total service visits and work orders. Notable, too, is that the service market is bigger and is providing more revenue to dealer and non-dealer service facilities, though these facilities can take simple, inexpensive steps to achieve even higher customer satisfaction.

“The pandemic threatened to take a big bite out of service business, but both authorized dealers and independent service shops were able to increase their revenue,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “While satisfaction is up, service providers must be vigilant in maintaining their focus to continue improving year over year as they face market headwinds.”

Now in its third year, the study is a comprehensive analysis of the service experience among owners of three- to 12-year-old vehicles. It evaluates customer satisfaction with their dealer or non-dealer service center by examining five key measures (in order of importance): service quality (27%); service advisor (22%); service initiation (19%); service facility (17%); and vehicle pick-up (15%). Satisfaction is calculated on a 1,000-point scale.

The study finds that even with less service taking place, both dealers and non-dealers are generating more revenue and increasing the size of the total Mexican aftermarket. Dealer facilities saw a slight reduction to 1.1 visits in 2021 from 1.3 in 2020, while non-dealers had a greater decline to 1.6 visits from 2.0 a year ago. Despite the reductions, dealers and non-dealers saw an increase in the cost per repair order of 13% and 29%, respectively.

Customers had higher satisfaction with both dealer and non-dealer service operations this year. Owners of three- to 12-year-old vehicles are more satisfied than a year ago in all five factors. While non-dealer shops are closing the gap in service satisfaction to dealer operations, their overall satisfaction lags that of dealers by 32 points (797 vs. 829, respectively).

Following are some key findings of the 2021 study:

- Dealers can improve satisfaction without investing money: Providing simple services can help dealers improve customer satisfaction without additional expenditures. For example, just returning a customer’s car with the same settings it had when it was brought in can increase satisfaction 49 points. Providing a service appointment on the desired day has an even bigger impact on CSI. When a customer cannot get an appointment on the day they want, satisfaction drops 82 points. When customers feel they are not being kept informed about the status of the work, satisfaction drops 16 points.

- Price remains key advantage for non-dealer facilities: While dealer visits decreased this year mainly due the pandemic, spending on those visits did not. Yet, the same happened at both dealer and non-dealer facilities. The amount spent in service per visit at a dealership increased 13% from 2020, and spending at non-dealer service facilities increased 29%. Overall, the service bill in a dealer facility is 45.8% higher than in a non-dealer shop. As a vehicle gets older and warranties expire, customers continue to abandon dealer service for less-expensive non-dealer providers. Some 78% of original-vehicle owners of 2017-2018 model-year vehicles take their vehicle to a dealer while only 43% the owners of 2009-2014 model-year vehicles do so.

- Dealers charge more for most common types of service: Dealer service costs as much as 91% more than similar work provided by a non-dealer facility. Prices for lubrication/oil/filter change, brake work, and wheel alignment are at least 61% higher in a dealer facility than in a non-dealer shop. Only in tire maintenance, repair or replacement are dealer prices similar to those of non-dealer facilities.

Highest-Ranking Brands

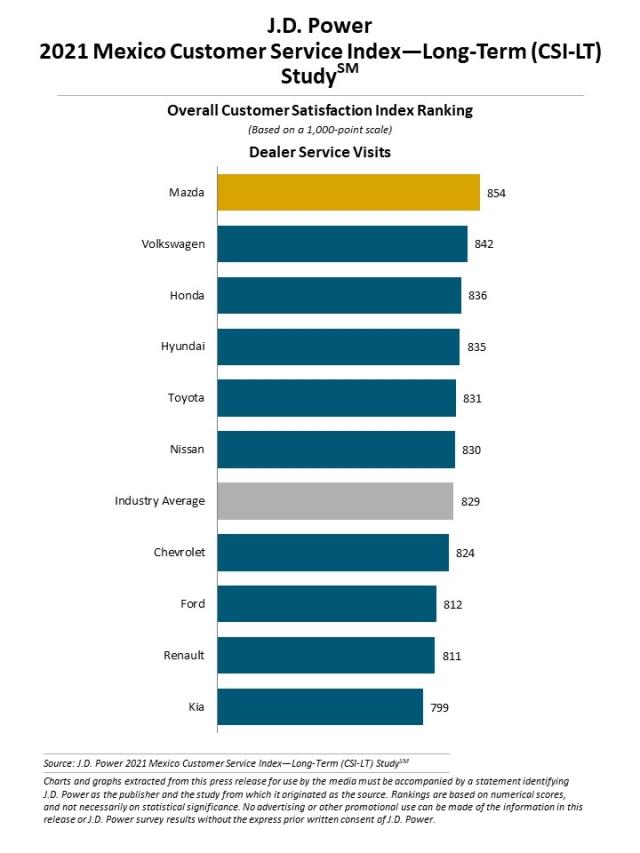

Mazda ranks highest in overall satisfaction among franchised dealers with a score of 854. Volkswagen (842) ranks second and Honda (836) ranks third.

The 2021 Mexico Customer Service Index—Long-Term (CSI-LT) Study is based on the evaluations of 2,925 interviews with new- and used-vehicle owners in Mexico approximately three to 12 years after purchase. The study was fielded from May through July 2021.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Jair Montes de Oca, JD Power; Mexico City; +5255 7940 9174; jair.montes@jdpa.com

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info