Saving Customers Time and Money Can Win Back Business for Dealership Service Centers, JD Power Finds

Honda Ranks Highest for Long-Term Satisfaction in Mexico

The combination of expiring vehicle warranties and a continual increase in service costs are pushing customers away from dealership service centers and toward non-dealer facilities, according to the JD Power 2020 Mexico Customer Service Index—Long-Term (CSI-LT) Study,SM released today.

“With new-vehicle sales forecasted to decline for the remainder of the year, dealerships can’t risk losing service customers,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “Service opportunities are already minimized, with decreased driving habits and lower demand for vehicle maintenance during this pandemic. Authorized dealerships should focus on developing improved pricing and retention strategies that focus on owners with older vehicles and expired warranties. Such owners offer dealerships a large pool of potential customers that shouldn’t be ignored.”

Because the revenue potential of the vehicle service industry in Mexico is more than $19 billion MXN annually, there is a significant opportunity for both dealers and non-dealers. Once vehicle warranties expire, authorized dealerships are losing business to non-dealers primarily due to pricing. Authorized dealers focus on driving per-visit revenue across fewer service visits while non-dealers generate less revenue per visit but with more visits.

The study finds that, while overall satisfaction among owners of three- to 12-year-old vehicles is 40 points higher (on a 1,000-point scale) at authorized dealerships than at non-dealer facilities, more than half (59%) of such vehicles are serviced at non-dealer facilities.

Following are some key findings of the 2020 study:

- Prioritizing customers’ time: When dropping off a vehicle for service, customers don’t want to waste time waiting to speak with an advisor about their service needs. Satisfaction scores improve 30 points when the wait time is two minutes or less. However, 66% of customers wait more than two minutes before talking to a service advisor at an authorized dealership vs. 46% of those at non-dealer facilities. Satisfaction is 54 points higher among customers who spend 11-20 minutes to complete paperwork, receive an explanation of charges from service advisors and pick up their vehicle than among those customers who complete paperwork but do not receive an explanation of charges or work performed. When customers receive explanations of charges and work performed, they are 13% more likely to return for service.

- Expired warranties translate to lost customers: As new-vehicle warranties, in general, expire after 36 months, dealers often lose customers at that point to non-dealer service facilities, with cost of service cited as the primary reason. Nearly half (43%) of customers with four- to seven-year-old vehicles visit non-dealer facilities purely for cost of service and 77% of customers with vehicles eight to 12 years old do so for the same reason. Dealers can improve perceived value in quality and overall service advisor performance by creating and communicating a competitive price strategy.

- Price is key motivator: Customers who receive vehicle service from non-dealer facilities spend an average of $1,208 MXN less than they would at authorized dealerships. There is a missed opportunity in providing customers at authorized dealerships with high-quality work at fair prices, as this is ultimately what is driving customers to non-dealer facilities.

- Most customers will return for routine maintenance: Not surprisingly, among the 92% of vehicle owners who intend to stick to regimented maintenance for their vehicles, 62% will do so to ensure their warranty remains intact and 56% will do so because they perceive it to be necessary for their vehicle.1 Conversely, the main reason vehicle owners will avoid returning for routine vehicle maintenance is because it is not a priority in their current financial situation (47%).

Study Rankings

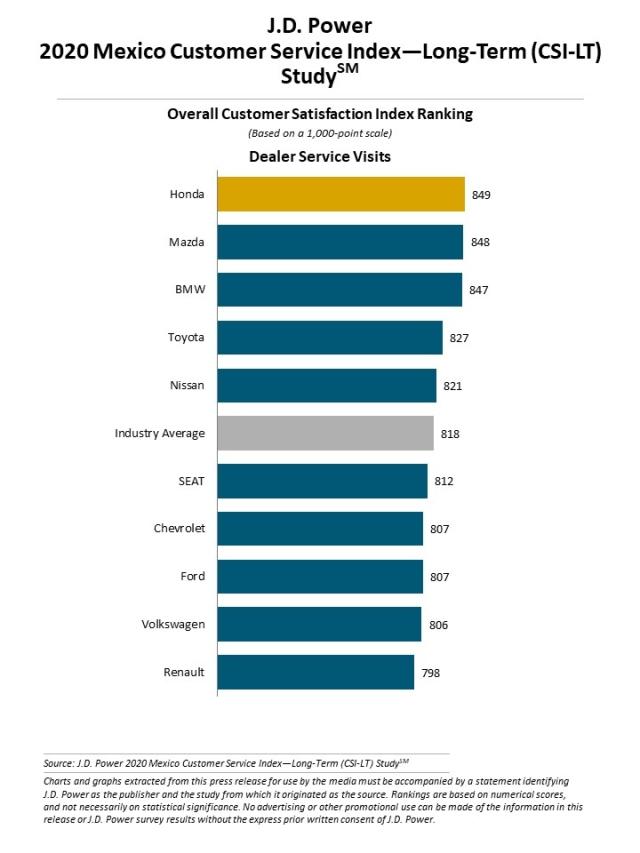

Honda ranks highest in overall satisfaction with a score of 849. Mazda (848) ranks second and BMW (847) ranks third.

The 2020 Mexico Customer Service Index—Long-Term (CSI-LT) Study is based on the evaluations of 2,854 interviews with owners in Mexico of new- and used-vehicles that are approximately 3 to 12 years old.

The study, now in its second year, is a comprehensive analysis of the service experience and evaluates customer satisfaction with their servicing dealer or non-dealer by examining five key measures (in order of importance): service quality (27%); service advisor (22%); service initiation (19%); vehicle pick-up (15%); and service facility (17%). The study was fielded from April through June 2020.

JD Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contact

Fabiana Duran; Mexico City; +52 55 1012 0885; fabianaduranp@gmail.com

Jair Montes de Oca; Mexico City; +52 55 4161 4318; jair.montes@jdpa.com

Geno Effler; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

1JD Power 2020 Mexico Automotive Consumer Confidence (MACC) Study