Attentive and Competent Dealer Personnel Enhance Sales Satisfaction in Mexico, JD Power Finds

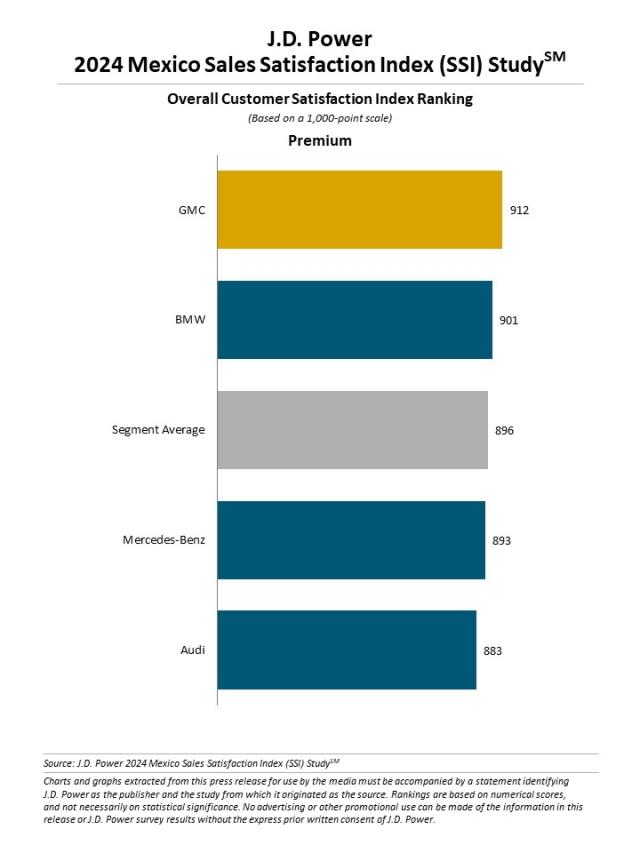

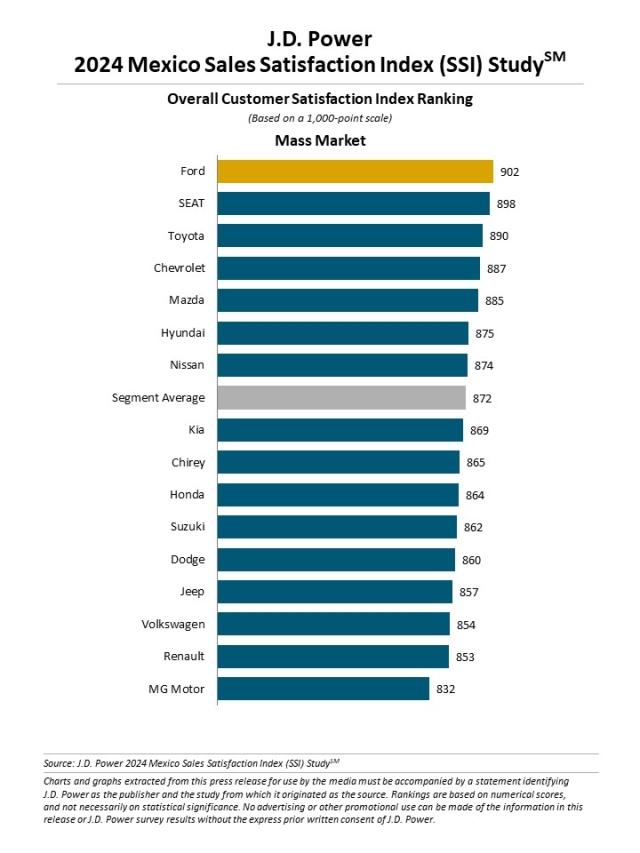

GMC Ranks Highest in Sales Satisfaction Overall; Ford Ranks Highest in Mass Market Segment

MEXICO CITY: 24 May 2024 — With the pandemic in the rearview mirror, the importance of interactions with dealer personnel and facilities in Mexico have increased among new-vehicle buyers, according to the JD Power 2024 Mexico Sales Satisfaction Index (SSI) Study, SM released today. Overall sales satisfaction declines to 873 (on a 1,000-point scale) from 876 a year ago. Satisfaction with brand website increases 7 points to 880, while facility rises 6 points to 842 (+6). However, these improvements are offset by 3-point declines with dealer personnel (880) and delivery process (890).

“A majority of dealer personnel are using some form of technology during the sales process,” said Gerardo Gomez, senior director and country manager at JD Power Mexico. “The make-or-break factor is how effectively the technology is used to facilitate the purchase process, as sales consultants are relying less on personal vehicle knowledge and more on devices. A sales consultant’s ability to seamlessly integrate technology throughout the experience is the most influential key performance indicator of sales satisfaction. Dealers can enhance the customer journey by ensuring sales personnel are familiar with technology at all points during the sales process. Additionally, greeting customers upon arrival is an easy way that dealers can further buoy satisfaction.”

Satisfaction with dealer personnel is highest (932) when they are very effective at using technology during the sales journey, but satisfaction declines to 820 when they are somewhat effective. Premium brands score higher than mass market brands across all six satisfaction measures in the study, with facility (+42 points); paperwork (+21); and delivery (+21) being the areas with the largest gaps.

Following are some key findings of the 2024 study:

- Room for improvement with customer and dealer interactions: Of the 10 most influential KPIs for dealers, a sales consultant’s effective use of technology has the largest effect on overall satisfaction (+44 points), yet it is completed at the lowest frequency (62%). Notable areas with low completion rates are: dealer contacted you to ensure everything met expectations (72%) and dealer staff demonstrate the use of the navigation system (78%). When completed, these measures have a 30-point and 27-point effect on satisfaction, respectively.

- Customers appreciate when dealers offer a test drive: Completing a test drive is important to most shoppers. Among shoppers who are able to take a test drive, satisfaction is 892. Among the 13% of shoppers who are unable to complete a test drive, satisfaction drops to 821 when a test-drive vehicle is not available and drops to 786 when a test drive is not offered or recommended. “It is clear that having test-drive vehicles available is important to shoppers,” Gomez said. “But even more important is the simple offer of a test drive, as satisfaction greatly improves when this occurs. Premium brands are better at doing this than mass market brands.

- Younger buyers more influenced by recommendations, online activities and advertising: Across all generational cohorts, excluding Gen Z,1 dealership location is the most influential factor that determines where they purchase a vehicle. Among Gen Z customers, 41% say they are swayed by recommendations from friends or family members, while 24% are influenced by advertising. Significant factors among Gen Y customers are internet searches (35%); dealership website (31%); online rating/review site (29%); and dealership facility appearance (26%).

- More shoppers rejecting at least one brand: The percentage of shoppers who say they avoided at least one brand increased to 61% this year, up from 49% a year ago. The top three reasons that buyers avoid a particular brand are unreliability; expensive to maintain; and friend/family experience.

Study Rankings

GMC ranks highest overall and among premium brands with a score of 912. BMW (901) ranks second.

Ford ranks highest among mass market brands with a score of 902. SEAT (898) ranks second and Toyota (890) ranks third.

The Mexico Sales Satisfaction Index (SSI) Study, now in its 11th year, provides automotive manufacturers and consumers with an objective measure of the satisfaction levels of new-vehicle buyers. The study emphasizes the relevance of the online vehicle shopping experience and examines customer satisfaction with the selling dealer across six measures (listed in order of importance): dealer personnel (28%); delivery process (21%); facility (20%); working out the deal (12%); paperwork (13%); and brand website (5%).

The study is based on evaluations of new-vehicle buyers in Mexico considering 2022-2024 models, after one to 12 months of ownership. The study was fielded from November 2023 through April 2024.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, JD Power; West Coast; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

1JD Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.