Chinese Automotive Brands Lag in Customer Trust and Service Satisfaction in Mexico, JD Power Finds

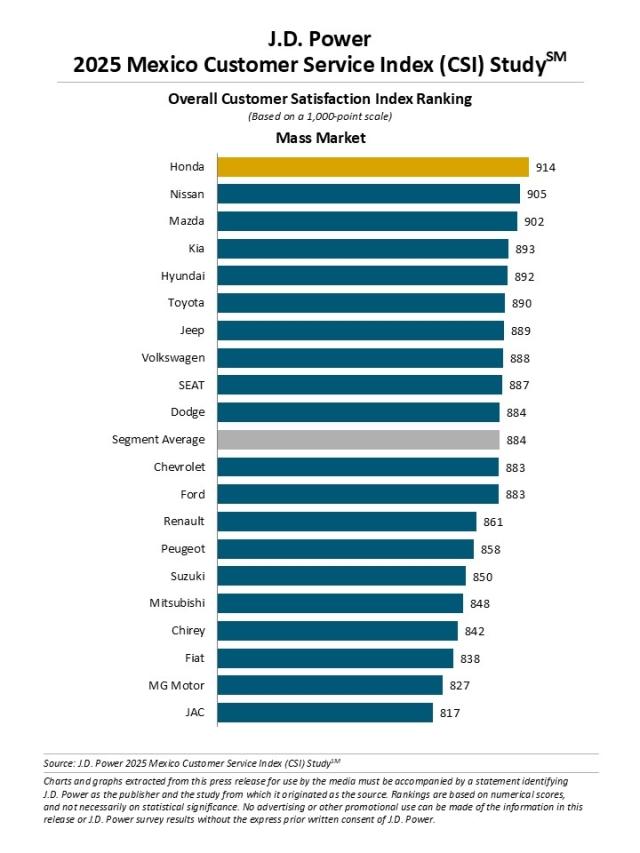

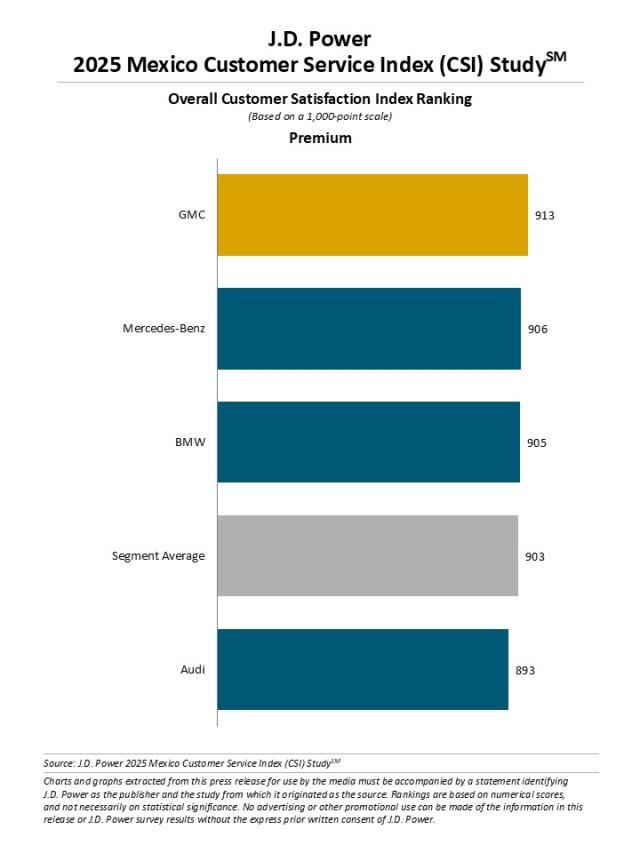

Honda Ranks Highest in Mass Market Segment, GMC Ranks Highest in Premium Segment

MEXICO CITY: 26 Sept. 2025 — For vehicle owners in Mexico this year, the expected quality of service at franchised dealerships continues to play a key role in loyalty, retention and future brand selection. However, a segment of that service market has yet to reach parity. The emerging Chinese automotive brands—still navigating their early stages in this market—are working to understand the drivers of customer service satisfaction. According to the JD Power 2025 Mexico Customer Service Index (CSI) Study,SM released today, service performance remains a critical differentiator, with Chinese-branded dealerships continuing to trail competitors in areas such as customer trust and perceived service quality.

Overall service satisfaction among mass market brands reaches 884 (on a 1,000-point scale), compared with 903 for premium brands. The 19-point gap highlights continued advancement, as mass market brands enhance their dealership service experiences. Trust in the servicing dealer among mass market customers, measured by seven attributes comprising the Trust Index, is 619 (on a 700-point scale), just six points below the score for premium vehicle owners (625).

“Dealer service is where brand promises to customers are either kept or broken, and Chinese brands overall are still working to earn that customer trust,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “To close the gap, those dealers must focus on honest communication, promptly owning and correcting any mistakes, and consistently deliver the technical expertise that builds customer confidence with every visit. Additionally, enhancing amenities like wireless internet access in the waiting area and improving customer greeting practices should be prioritized. Historically, Japanese brands have set the benchmark by consistently delivering on such service aspects.”

Following are some additional key findings of the 2025 study:

- Service satisfaction is highest among hybrid vehicle owners: In a positive sign for the burgeoning hybrid market in Mexico, overall satisfaction with dealer service is highest among hybrid vehicle owners (909), driven by strong performance in service initiation and advisor interaction. Service satisfaction among owners of plug-in hybrid (887), electric (887) and gasoline-powered vehicles (883) is lower, with gasoline vehicles trailing all alternative powertrain types.

- Owners of Chinese-branded vehicles spend less on service, experience lower satisfaction and have less loyalty: Owners of Chinese-branded vehicles report the lowest dealer service spending among all brand origins. However, this lower cost does not correlate with higher satisfaction: overall satisfaction among these owners is 827, which is 58 points below the industry average (885). Additionally, only 49% of these owners say they intend to return to the dealership for paid service — the lowest service loyalty rate across all brand origins and 13 percentage points below the average.

- Fix it right the first time—and own it when a mistake is made: Satisfaction among nearly all (97%) service customers who say their service was completed correctly the first time is 887, but satisfaction among the remaining 3% is much lower often due to issues like undiagnosed problems (29%) or unavailable parts (26%). The dealer response plays a critical role, as satisfaction rebounds the most (to 864) when issues are resolved immediately, but drops when problems are denied, affecting nearly one in four customers. Fixing it right the first time also drives customer loyalty, as 63% of customers say they would return for paid work versus only 28% who say the same when service isn’t done correctly.

- Servicing at the selling dealership drives higher customer satisfaction and trust: Among customers who service their vehicle at the selling dealership, satisfaction and trust levels are notably higher than among customers who take their vehicle to a non-selling dealership. This results in a 45-point advantage in the Customer Service Index score (890) and a 34-point lead in the Trust Index (623), compared with those who visit non-selling dealerships. Additionally, 88% of customers return to the selling dealership for future service—often due to lower out-of-pocket costs. Specifically, 59% say they did not pay for service at the selling dealership, compared with 41% at non-selling dealerships. While first-time repair quality is consistent across both dealer types, 92% of customers of selling dealerships say their vehicle was ready as promised—9 percentage points higher than those who use non-selling dealerships.

Highest-Ranking Brands

GMC ranks highest in the premium segment with a score of 913. Mercedes-Benz (906) ranks second and BMW (905) third.

Honda ranks highest in the mass market segment with a score of 914. Nissan (905) ranks second and Mazda (902) third.

Now in its 10th year, the Mexico Customer Service Index (CSI) Study is a comprehensive analysis of the service experience among owners of one- to three-year-old vehicles and evaluates customer satisfaction with their authorized dealer by examining five key measures (in order of importance): service quality (31%); service facility (20%); service initiation (18%); service advisor (17%); and vehicle pick-up (15%).

This year’s study is based on the evaluations of 6,683 new-vehicle owners of 2022, 2023 or 2024 model-year vehicles who took their vehicle for service to an authorized dealer facility in the past 12 months. The study was fielded from November 2024 through July 2025.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit jdpower.com/business.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Joe LaMuraglia, JD Power; East Coast; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules: https://www.jdpower.com/business/about-us/press-release-info