Digital Drives Improvement for Vehicle Service Satisfaction in Mexico, JD Power Finds

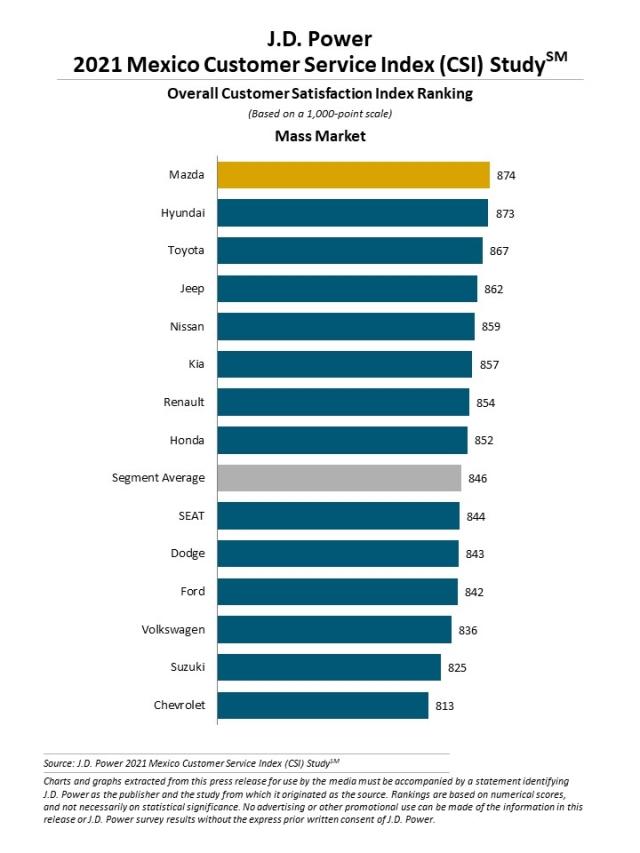

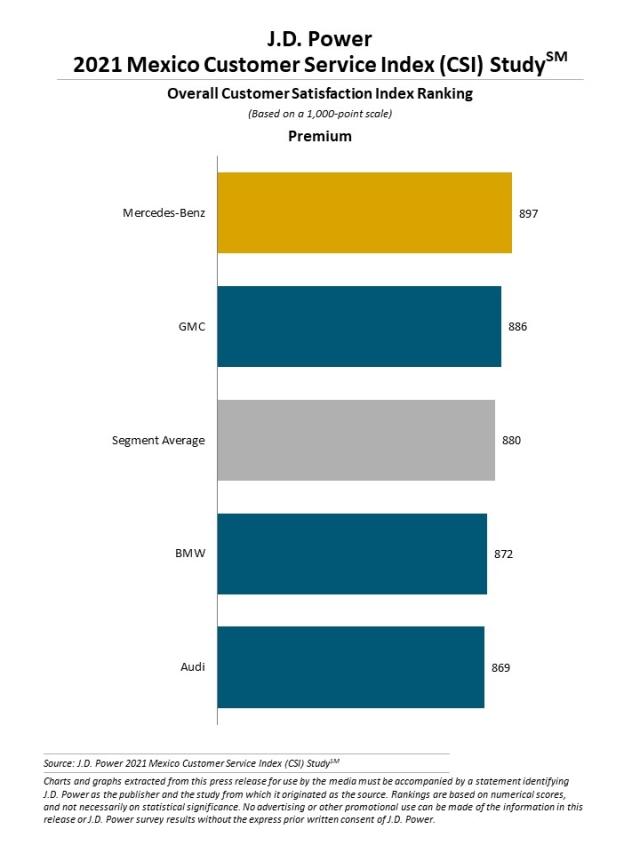

Mazda and Mercedes-Benz Rank Highest in Respective Segments

The COVID-19 pandemic accelerated the adoption of technology in dealerships throughout Mexico and has had a positive effect on customer service satisfaction. According to the JD Power 2021 Mexico Customer Service Index (CSI) Study,SM released today, customer service overall satisfaction increases to 850 (on a 1,000-point scale) from 833 a year ago. Overall satisfaction also increases for a fifth consecutive year.

Premium segment customers, on average, are more satisfied with their service experience (880) than owners of mass market vehicles (846). While a proper greeting and explaining the service that will be done are key components of satisfaction, service quality increases 25 points, the most-improved factor in the study.

“The pandemic pushed digital sales to the forefront and owners want to keep having a digital experience when servicing their vehicle,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “Satisfaction is up and it could be even higher. Dealers taking to technology have an advantage with customer retention and loyalty. When mixing in attention to detail and hyper communicating with a customer throughout the entire service experience, you have a winning formula for high service satisfaction.”

Now in its sixth year, the study is a comprehensive analysis of the service experience among owners of 1- to 3-year-old vehicles and evaluates customer satisfaction with their authorized dealer by examining five key measures (in order of importance): service quality (25%); service advisor (21%); vehicle pick-up (19%); service facility (17%); and service initiation (16%).

Following are some key findings of the 2021 study:

- Service scheduling apps increase customer satisfaction: The fastest-growing channels for scheduling a service appointment are text message/messaging app and the internet. Both have increased by seven percentage points since 2019. However, 52% of customers who do not use internet to schedule a service appointment—and would like to do it through this channel—are not aware that a dealership offers service scheduling on the internet. Providing customers with the option to text or schedule an appointment online increases satisfaction, and dealers who follow up with a confirmation call see a 43-point improvement in satisfaction than when a confirmation call is not made (887 vs. 844, respectively). When asked what their future preferred channel would be for scheduling a service appointment, 50% of customers indicate text, online or app.

- Greater attention increases satisfaction: The number of times the dealership interacts with customers during a service visit—from drop-off to pick-up—has a significant effect on satisfaction. When advisors efficiently and effectively meet all nine measured touchpoints during a vehicle service experience, customers have a 106-point increase in satisfaction (844 vs. 951) than if only a minimum of three touchpoints are met. Higher satisfaction also leads to customers being more inclined to return for future service visits.

- Keys to service satisfaction: Four of the 10 key performance indicators (KPI) in the study focus on the customer’s time. From a customer having to wait fewer minutes in the service drop-off line to an attentive advisor ready to help when the customer returns, satisfaction can swing significantly. This year, the two lowest KPIs are related to time: it took too long to talk with a service advisor when dropping off a vehicle (40%) and taking less than 18 minutes to complete paperwork at delivery (68%). Improving these two KPIs can improve scores by as much as 82 points.

- Pandemic-driven method of payment: Influenced by pandemic-related protocols, nearly two-thirds (63%) of customers used a credit/debit card to make their payment, which is an increase from 54% in 2017. This is notable because, customer satisfaction among those who use a credit/debit card has increased to 836 from 795 in 2017.

Highest-Ranking Brands

Mazda ranks highest in the mass market segment for a second consecutive year, with a score of 874. Hyundai (873) ranks second and Toyota (867) third.

Mercedes-Benz ranks highest in the premium segment with a score of 897. GMC (886) ranks second.

The 2021 Mexico Customer Service Index (CSI) Study is based on the evaluations of 4,918 interviews with new-vehicle owners in Mexico approximately 12 to 36 months after purchase. The study was fielded from May through September 2021.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Jair Montes de Oca, JD Power; Mexico City; +5255 7940 9174; jair.montes@jdpa.com

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info