New Brands in Mexican Market Drag Down Overall Customer Service Satisfaction, J.D. Power Finds

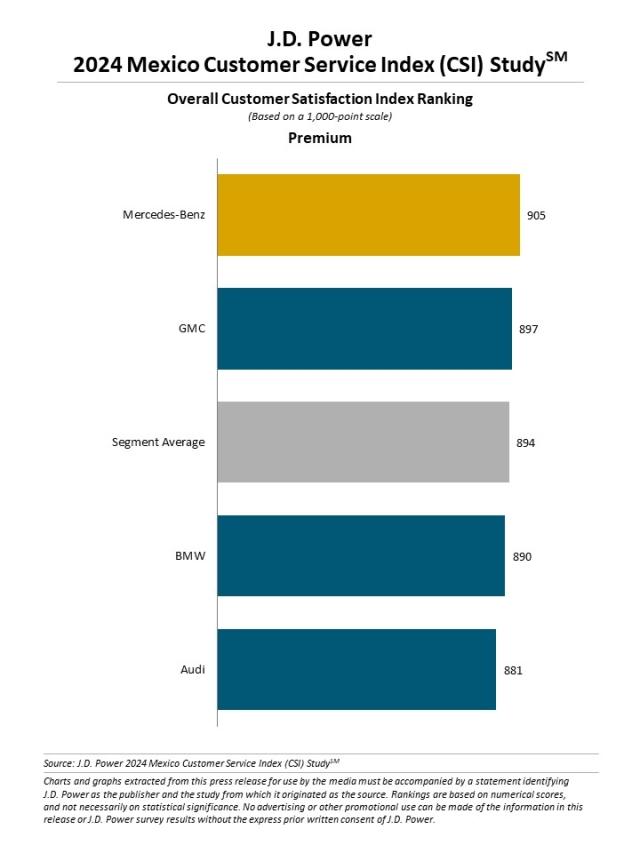

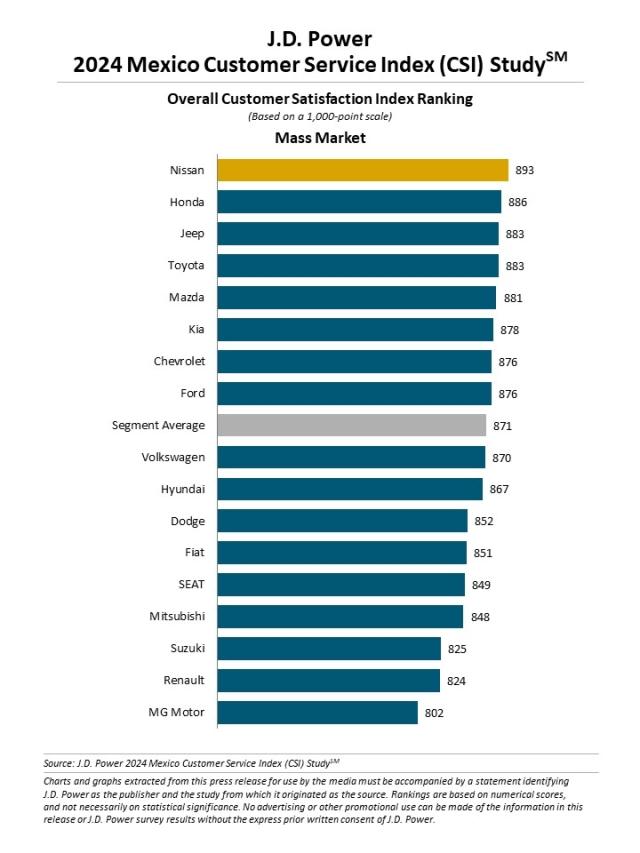

Mercedes-Benz Ranks Highest in Premium Segment, Nissan Ranks Highest in Mass Market Segment

MEXICO CITY: 19 Sept. 2024 — While the automotive dealer service market shows signs of recovery in Mexico, overall customer satisfaction with service at franchised dealerships has slightly declined in both the mass market and premium segments, according to the J.D. Power 2024 Mexico Customer Service Index (CSI) Study,SM released today. Service satisfaction among mass market brands is 871 (on a 1,000-point scale)—down from 872 in 2023—while service satisfaction among premium brands is 894, down from 899 a year ago.

The decline in overall satisfaction can be attributed in part to the growing number of new brands entering the market, mainly Chinese brands. Satisfaction with dealer service among owners of Chinese vehicles is the lowest (787), while satisfaction with Japanese brands is the highest (882). This difference stems in part from how often dealers can successfully perform service work the first time, with 98% of owners of Japanese vehicles saying the work was performed correctly but only 93% of Chinese vehicle owners saying the same.

Notable, too, is that the satisfaction gap between mass market and premium brands is 23 points, the closest it has ever been in the history of the study.

“Due to warranties and maintenance packages, owners of Chinese-brand vehicles spend the least amount of money at dealers compared with brands from other countries,” said Gerardo Gomez, senior director and country manager at J.D. Power de Mexico. “What’s interesting, though, is that spending less at dealers does not necessarily translate to higher satisfaction. Moreover, 16% of customers who own a Chinese-branded vehicle say they will not return to the dealer for paid service—the highest proportion across all brand origins—despite spending significantly less money for service. It is imperative that dealers perform service work correctly the first time around to avoid additional visits and headaches for customers.”

Following are some additional key findings of the 2024 study:

- Customers desire intentional communication: A simple yet effective way that dealers can improve satisfaction is to proactively communicate with customers about their vehicle. When dealers contact customers to inform them that their vehicle is due for service, satisfaction increases 34 points—yet only 24% of customers say they received such communication. Nearly half (41%) of customers rely on the factory maintenance schedule, which results in the lowest satisfaction score across all notification types (862). Any kind of communication regarding service needs beyond the maintenance schedule—whether it be a window sticker from a prior service visit or a dashboard indicator message—improves customer satisfaction.

- Overall customer trust declines: Customer trust with servicing dealers slips this year across all seven attributes that comprise the Trust Index, with dealer personnel knowing how to use technology to improve service efficiency seeing the largest drop (-0.11 points on a 7-point scale). Customers trust dealers the least when it comes to taking responsibility when a mistake is made and effectively resolving it (5.95); and providing useful guidance or advice (5.98). Furthermore, premium vehicle owners place more trust in their dealers than do mass market vehicle owners.

- Hybrids have less maintenance but more repair work than gas-powered vehicles: Many owners appreciate hybrid vehicles for their similar ownership experience to that of internal combustion engine (ICE) vehicles. However, 53% of hybrid owners say they took their vehicle in for service during the previous 12 months vs. 38% of ICE vehicle owners. The most common service items among hybrids include alignment; tire repair; and heating, ventilation and air conditioning work. Despite this, owners of hybrid vehicles are more satisfied with dealer service (889) than owners of ICE vehicles (871).

- Best alternative for warranty is a maintenance package: Satisfaction among customers is highest when dealer service charges are covered under warranty (905) but decreases 67 points when customers pay for all charges and drops 57 points when customers pay for some of the charges. However, when charges are covered by a maintenance package, satisfaction declines only 34 points.

- Key areas for improvement: Overall customer satisfaction with the dealer service experience has decreased this year. Two areas with low completion rates among dealers include the advisor handling payment for service (33%) and wireless internet access (48%). When these services are offered, there is an increase of 69 points and 47 points, respectively. Dealers also should focus on contacting customers via phone, text or email after service completion. When doing so, satisfaction increases 31 points.

Highest-Ranking Brands

Mercedes-Benz ranks highest in the premium segment with a score of 905. GMC (897) ranks second and BMW (890) third.

Nissan ranks highest in the mass market segment with a score of 893. Honda (886) ranks second, while Jeep (883) and Toyota (883) each rank third in a tie.

Now in its ninth year, the Mexico Customer Service Index (CSI) Study is a comprehensive analysis of the service experience among owners of one- to three-year-old vehicles and evaluates customer satisfaction with their authorized dealer by examining five key measures (in order of importance): service quality (31%); service facility (20%); service initiation (18%); service advisor (17%); and vehicle pick-up (15%).

This year’s study is based on the evaluations of 5,286 new-vehicle owners of 2021, 2022 or 2023 model-year vehicles who took their vehicle for service to an authorized dealer facility in the past 12 months. The study was fielded from November 2023 through August 2024.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx Geno Effler, J.D. Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info