Broken Promises on Vehicle Deliveries Stall New-Vehicle Sales Satisfaction in Mexico, J.D. Power Finds

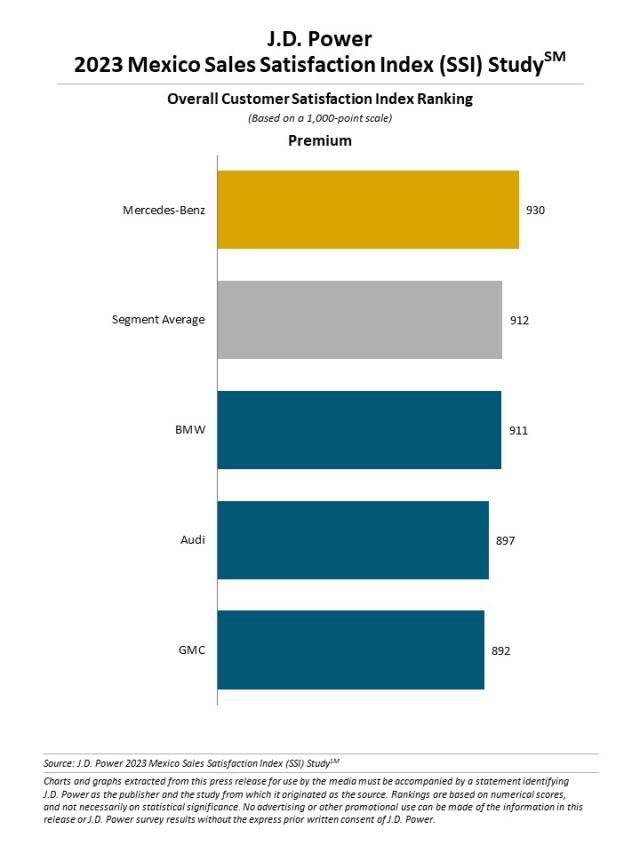

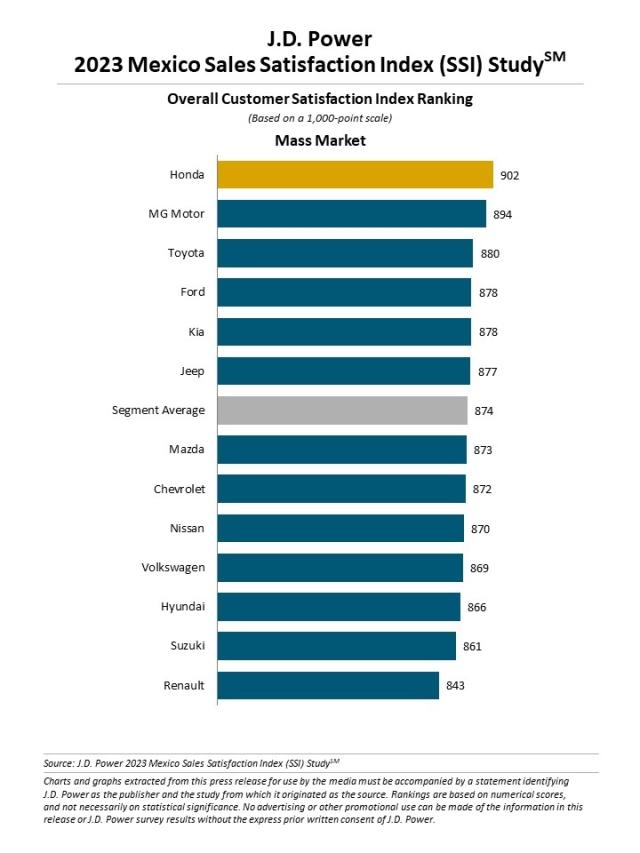

Mercedes-Benz Ranks Highest in Sales Satisfaction Overall; Honda Ranks Highest in Mass Market Segment

MEXICO CITY: 27 April 2023 — Missed vehicle deliveries are putting the brakes on buyer satisfaction, which should motivate dealers to improve their communications throughout the shopping experience in order to buoy overall satisfaction, according to the J.D. Power 2023 Mexico Sales Satisfaction Index (SSI) Study,SM released today. A key performance indicator (KPI) for satisfaction is the sales delivery process which declines to 893 (on a 1,000-point scale) from 897 a year ago. The promised delivery day and time is met 88% of the time by dealers, 2 percentage points lower than a year ago and the only KPI to decline in the study. Delivering a customer’s new vehicle on the day and time promised improves satisfaction 164 points.

“Solutions abound for how dealerships can improve satisfaction during the shopping experience and one way is through proactive communication,” said Gerardo Gomez, senior director and country manager at J.D. Power Mexico. “Clearly communicating with shoppers throughout the vehicle delivery process can have a tremendously positive effect on sales satisfaction. And, communicating with customers through their preferred channel—including text messaging or technology at the dealership—can keep them more satisfied with the sales process and less inclined to defect to another retailer.”

The study reveals modest year-over-year increases in two areas that make up 25% of the sales satisfaction index: paperwork (+5 points) and working out the deal (+2). “There are a couple of bright spots in the sales satisfaction experience this year, however the number of areas that improved is one fewer than a year ago. Brands need to treat this as an inflection point by addressing other areas including key customer touchpoints like facilities, websites and delivery process,” Gomez said.

Following are some key findings of the 2023 study:

- Digital shopping journeys vary by generation: While buyers overall continue to migrate away from visiting a brand’s website or calling a dealer, text messaging a dealership is on the rise during the past three years. However, the largest group (22%) choosing to text message with a dealership is Gen Z1 at 22%. While Gen Y and Gen X are more likely to visit the brand and/or dealer website during the act of shopping for a new vehicle. Brands can improve satisfaction with their website by 102 points when including vehicle pricing. Offering an online chat feature can increase satisfaction 43 points. “This is a message to dealers that they need to be ready to accommodate customers through all of the digital sales channels,” Gomez said.

- Buying without taking a test drive: The percentage of new-vehicle shoppers taking a test drive has declined to 57% from 67% in 2021. During the same time, the number of new-vehicle buyers going to a dealership in person increased to 100% from 98%. One of the primary reasons for fewer test drives is that a vehicle was not available at the dealership. “What once was a given for buying a new vehicle has now dramatically decreased in the buying process,” Gomez said. “Test drives are a great way to build relationships with customers by showcasing and answering any questions about the vehicle. A good sales experience can lead to future service visits.

- Tactics that diminish dealer reputations: Dealers using bait-and-switch techniques to lure in new-vehicle shoppers and then charging them more than the advertised or original price of the vehicle have their Net Promoter Score®2 cut nearly in half. Not only is advocacy for the dealership being diminished, but the effect on satisfaction is a decline of 117 points. Additionally, the price paid affects the percentage of buyers who say they “definitely will” return to the dealership for future service—a major revenue stream for franchised dealerships. There are fewer new-vehicle buyers mentioning that they will return when paying more than the advertised or original price (48%) than buyers paying the original price (68%).

- Leasing increases but barriers exist: While leasing is still relatively low in the market, lease volume has increased 2 percentage points year over year among buyers of mass market vehicles. New to the study this year is the analysis of reasons why buyers are not choosing leasing as a payment option. Barriers to increasing leasing portfolios include: the leasing plan was not attractive (28%); a leasing purchase option was not offered (27%); and the advisor did not explain the leasing characteristics (15%). Satisfaction among buyers with leases (874) is slightly above those who took out a loan (869).

- Half of new-vehicle shoppers are avoiding at least one brand: The top three reasons why a buyer is staying away from a brand are: unreliability (23%); brand reputation (18%); and expensive to purchase (17%).

Study Rankings

Mercedes-Benz ranks highest overall and among premium brands with a score of 930.

Honda ranks highest among mass market brands with a score of 902. MG Motor (894) ranks second and Toyota (880) ranks third.

The Mexico Sales Satisfaction Index (SSI) Study, now in its 10th year, provides automotive manufacturers and consumers with an objective measure of the satisfaction levels of new-vehicle buyers. The study emphasizes the relevance of the online vehicle shopping experience and examines customer satisfaction with the selling dealer across six measures (listed in order of importance): delivery process (27%); dealer personnel (25%); facility (16%); working out the deal (13%); paperwork (12%); and brand website (7%).

The study is based on evaluations of 3,263 new-vehicle buyers in Mexico considering 2021-2023 models, after one to 12 months of ownership. The study was fielded from October 2022 through February 2023.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies. J.D. Power has offices in North America, Europe and Asia Pacific.

Media Relations Contacts

Fabiana Duran; Ciudad de México; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, J.D. Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

2Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.