Nine of 10 New-Vehicle Buyers in Mexico Shop Multiple Brands Before Making Purchase, JD Power Finds

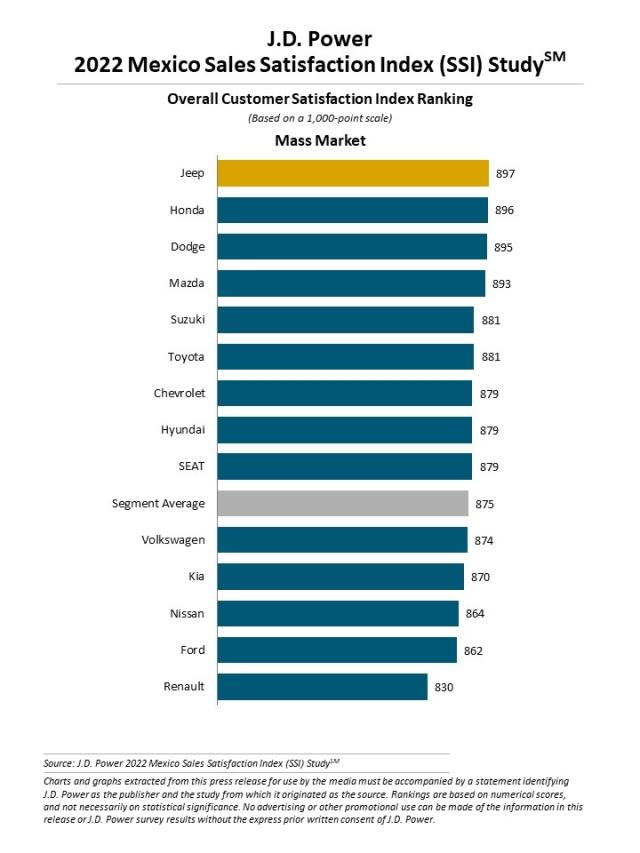

Jeep Ranks Highest in Sales Satisfaction in Mass Market Segment

With 87% of new-vehicle buyers in Mexico researching different brands before buying a vehicle, the dealership experience plays an important role in building and maintain brand loyalty, according to the JD Power 2022 Mexico Sales Satisfaction Index (SSI) Study,SM released today. Yet, despite vehicle inventory at dealerships being lower than normal due to global supply chain disruptions, satisfaction with the sales experience improves to 876 (on a 1,000-point scale) from 869 a year ago.

“Dealerships have overcome what might be a challenging sales situation and improved upon key satisfaction areas for buyers,” said Gerardo Gomez, senior director and country manager at JD Power Mexico. “However, the dealers’ work has just started in the digital channel, as opportunities persist with improving their website user experience by focusing more on inventory and making accurate pricing available. These are two key areas that will make the sales experience even better. Also, dealer facilities are an important element to address as in-person visits increase.”

The study reveals that the overall slight index increase was bolstered by year-over-year category improvements in three areas which make up 64% of the sales satisfaction index: paperwork (+14 points); dealer personnel (+8); and delivery process (+6). Nearly all six categories witnessed an index improvement from 2021, with only the brand website being unchanged. “This is a critical moment for brands to address their websites because 61% of new-vehicle buyers visit those sites during the purchase process. It’s an opportunity to capture new buyers and retain existing customers,” Gomez said.

Following are some key findings of the 2022 study:

- Dealers trying to catch up to brand reputations: Dealers of only four of 22 brands—Dodge, GMC, Peugeot and Mercedes-Benz—meet their brand’s Net Promoter Score®.[1] With such a small percentage of brands whose dealers meet that threshold, an opportunity exists since 71% of new-vehicle buyers say they are willing to recommend both the brand and dealer to friends and family. “This is a tremendous opportunity for dealerships to bring up their sales experience and match what brands have established in the eyes of buyers,” Gomez said.

- Value of digital experience continues to grow: With 72% of buyers visiting a brand or dealer website before purchasing a vehicle, the next closest action taken—called the dealer—decreased to 32% from 37% a year ago. Brands can improve satisfaction with their website by 106 points, on average, when they include vehicle pricing and another 35 points by adding an online chat option.

- Good sales experience can lead to service visits: Nearly two-thirds (64%) of new-vehicle buyers say they definitely will return to the dealership for future service work if the sales experience is satisfactory. However, based on their sales experience, a 240-point gap exists between buyers who say they definitely will return (914) and those who say they probably/definitely will not return (674).

- Highest satisfaction is with finance managers and product specialists: Buyers have the highest level of satisfaction with finance managers (908) and product specialists (907), while satisfaction with salespeople (881) is the lowest. However, finance managers and product specialists were involved in the sales process only 25% and 18% of the time, respectively. Salespeople can positively affect satisfaction by 42 points with a greeting upon the customer’s arrival—but only 89% of salespeople do so.

- Electric vehicle (EV) consideration: As consideration of electric vehicles increases, hybrid vehicles that run on gasoline and battery power still play an important role. Nearly four in 10 (39%) of new-vehicle buyers say they will consider a hybrid while only 15% say they will consider a fully electric vehicle. Among those who said they did not consider purchasing an EV, more than half (52%) cited charging station availability as a reason.

Study Ranking

Jeep ranks highest among mass market brands, with a score of 897. Honda (896) ranks second and Dodge (895) ranks third.

The premium segment is not award eligible due to insufficient sample sizes.

The Mexico Sales Satisfaction Index (SSI) Study, now in its ninth year, provides automotive manufacturers and consumers with an objective measure of the satisfaction levels of new-vehicle buyers. The study emphasizes the relevance of the online vehicle shopping experience and examines customer satisfaction with the selling dealer across six measures (listed in order of importance): delivery process (27%); dealer personnel (25%); facility (16%); working out the deal (13%); paperwork (12%); and brand website (7%).

The study is based on evaluations of 3,195 new-vehicle buyers in Mexico considering 2020-2022 models, after one to 12 months of ownership. The study was fielded from November 2021 through February 2022.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies. JD Power has offices in North America, Europe and Asia Pacific.

Media Relations Contacts

Ana Pelaez, JD Power; Mexico City; +52 55 7474 4075; ana.pelaez@jdpa.com

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.