Digital Automotive Retail Processes Need to Evolve in Mexico, JD Power Finds

Toyota Ranks Highest in Mass Market Segment for New-Vehicle Sales Satisfaction

Vehicle buyers in Mexico were generally satisfied with the sales experience at a dealership during the height of the pandemic, but they were less satisfied with experiences involving a brand’s website, a dealer’s website and completing paperwork, according to the JD Power 2021 Mexico Sales Satisfaction Index (SSI) Study,SM released today. For example, satisfaction declines 105 points (on a 1,000-point scale) when a buyer finds vehicle pricing difficult to understand on the website compared with someone who has no pricing problem.

“When 40% of buyers find at least one pricing problem on a brand’s website, it illuminates an issue that needs to be addressed quickly by manufacturers,” said Gerardo Gomez, senior director and country manager at JD Power Mexico. “Right now, buyers say they have a satisfying experience when they visit the dealership, but many are looking for a digital alternative to conduct many of the steps involved in purchasing a vehicle. Failing to recognize this—and failing to take corrective measures—will affect sales and retention.”

The study, redesigned for 2021, reveals that dealers took decisive steps at the beginning of the pandemic to adapt to buyers’ needs when visiting the dealership. At the height of the pandemic, 94% of vehicle buyers were still visiting the dealership. Most in-person visits were to view the vehicle (87%) and/or to complete paperwork (77%). “This reinforces the need for brands and dealers to ensure a safe and efficient visit—but it also points out the need to implement digital processes that may provide people with the alternative to stay at home and still complete many steps of the transaction,” Gomez said.

Following are some key findings of the 2021 study:

- Premium dealers are best at meeting customers’ expectations: Premium vehicle buyers are the most satisfied across the study’s six factors, with overall satisfaction of 894. That score is 26 points higher than mass market buyers and 25 points higher than commercial vehicle (pick-ups and vans) buyers.

- Product specialists drive high sales satisfaction: Satisfaction increases 29 points when buyers interact with a product specialist during the sales experience than when they work with a salesperson. However, this only happens 25% of the time. When a salesperson isn’t involved in any part of the sales process, satisfaction improves 37 points. Dealers should encourage more involvement of product specialists throughout the sales process to improve satisfaction. The study shows that salespeople can improve the sales experience by being respectful of the customer’s time, efficiently using technology during the sales process and communicating effectively.

- Avoiding certain brands comes down to cost and reliability: When shopping for a new vehicle, 51% of buyers say they considered any brand on the market. However, customers cite monetary concerns as a reason why they avoid a particular brand. The top reasons that buyers of premium brands avoid purchasing a vehicle from other premium brands are exterior design (20%) and cost to maintain the vehicle (19%). The leading reason why buyers of mass market brands avoid other mass market brands is unreliability (29%).

- Follow-up is essential to a great sales experience: More than one-fourth (26%) of buyers are not contacted by their dealer once the vehicle has been delivered. Satisfaction among these buyers is 105 points lower than those buyers who were contacted after delivery. When dealers offer to schedule the vehicle’s first service visit—which only happens 75% of the time—satisfaction is 83 points higher than when a visit is not scheduled. It’s critical for dealers to follow a delivery checklist to ensure dealer personnel are providing the customer with a satisfying sales experience.

Study Rankings

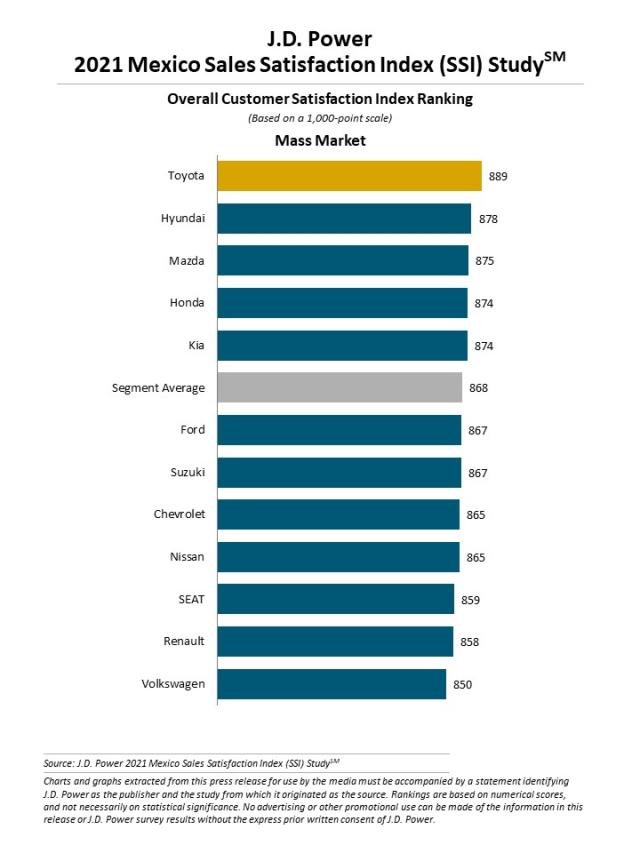

Toyota ranks highest among mass market brands, with a score of 889, a 19-point increase from 2020. Hyundai ranks second (878), followed by Mazda (875).

The premium segment and commercial vehicle segment (new to the study in 2021) are not award eligible due to insufficient sample sizes.

The Mexico Sales Satisfaction Index (SSI) Study, now in its eighth year, has been redesigned for 2021 to emphasize the relevance of the online vehicle shopping experience. It examines customer satisfaction with the selling dealer across six measures (listed in order of importance): delivery process (27%); dealer personnel (25%); facility (16%); working out the deal (13%); paperwork (12%); and brand website (7%).

The study is based on evaluations of 2,761 new-vehicle owners in Mexico after one to 12 months of ownership. The study was fielded from November 2020 through March 2021.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabianaduranp@gmail.com

Brais Álvarez Gallardo, JD Power; Mexico City; +52 1 55 7474 4074; brais.alvarez@jdpa.com

Geno Effler, JD Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info