Customer Service Satisfaction Improves in Mexico But Dealers Missing Opportunity, JD Power Finds

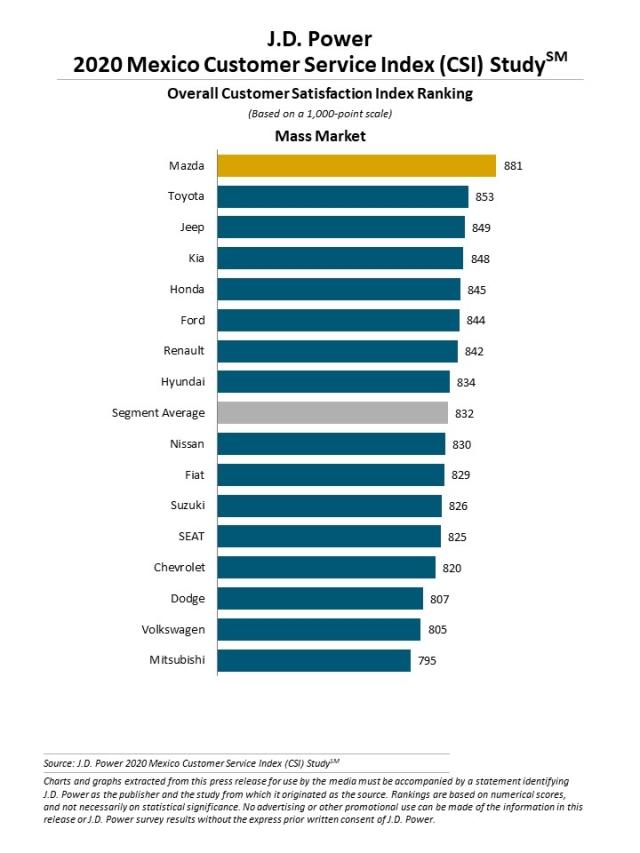

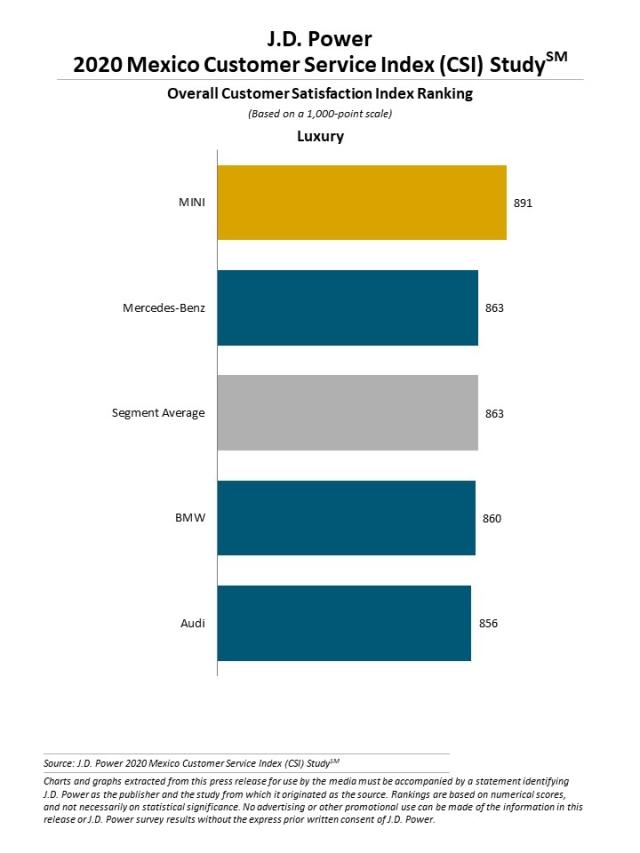

Mazda Ranks Highest among Mass Market Brands; MINI Ranks Highest among Luxury Brands

While vehicle customer service satisfaction in Mexico improves for a fourth consecutive year, authorized dealerships continue to lose a notable share of the service market to independent service facilities while warranties are still valid, according to the JD Power 2020 Mexico Customer Service Index (CSI) Study,SM released today.

“New-vehicle sales will decline this year, so it’s critical that dealers take necessary steps to convince owners to return to the dealership for service instead of going to an independent shop,” said Gerardo Gomez, senior director and country manager at JD Power de Mexico. “There’s a significant drop-off within the first three years of ownership, when customers start visiting independent shops more frequently. In the first year alone, 11% of customers are taking their vehicles to independent shops, and it jumps to 20% by the third year. Dealerships that make the necessary changes to increase satisfaction and retention also can see increased revenue.”

The study, now in its sixth year, is a comprehensive analysis of the service experience among owners of 1- to 3-year-old vehicles and evaluates customer satisfaction with their servicing authorized dealer or independent service facility by examining five key measures (in order of importance): service quality (25%); service initiation (24%); service advisor (20%); vehicle pick-up (16%); and service facility (16%). The overall Customer Service Index is calculated on a 1,000-point scale.

Following are some of the key findings of the 2020 study:

- Customers aren’t receiving explanation of charges: Although most customers are receiving an explanation of the work performed on their vehicles, 31% aren’t receiving an explanation of charges for the work. Furthermore, customer satisfaction drops 168 points when paperwork takes longer than 17 minutes to complete and an explanation of the charges isn’t provided. Authorized dealers have a significant opportunity to increase satisfaction by spending some time (nine minutes or less is ideal) explaining to customers the charges for the work performed on their vehicles.

- Greeting from service advisor: Only 39% of customers say they are greeted by a service advisor within two minutes of arrival at the dealership. When service advisors perform this simple task, satisfaction increases 49 points.

- More on service advisors: If the service advisor handles the payment process rather than the cashier, customers perceive the charges to be more fair and accurate, resulting in a satisfaction increase of 19 points. However, service advisors are a bit slower than cashiers, so improving the efficiency of advisors doing paperwork, including payment processing, could contribute to increased satisfaction.

- Older vehicles are missed opportunity: Once a typical vehicle warranty ends after three years, service visits tend to increase—up to 3.5 times a year, on average, for a 10-year-old vehicle. However, 71% of customers with a 10-year-old vehicle will visit an independent service facility instead of an authorized dealership. It should also be noted that, contrary to popular belief, authorized dealerships tend to charge 18% less for repairs than do independent facilities. Correcting this stereotype impression can provide an additional business opportunity.

- Phone calls preferred, but desire for messaging apps increases: While 45% of customers would prefer to schedule their future appointments by phone, dealers should embrace a growing customer preference to schedule future appointments via text message or messaging app—a preference that has increased to 15% in 2020 from 10% in 2019.

Highest-Ranking Brands

In the mass market segment, Mazda ranks highest in overall customer satisfaction with a score of 881. Toyota (853) ranks second and Jeep (849) ranks third.

In the luxury segment, MINI ranks highest in overall customer satisfaction with a score of 891. Mercedes-Benz (863) ranks second.

The 2020 Mexico Customer Service Index (CSI) Study is based on the evaluations of 5,961 interviews with new-vehicle owners in Mexico approximately 12 to 36 months after purchase. The study was fielded from April through September 2020.

JD Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contact

Fabiana Duran; Mexico City; +52 55 1012 0885; fabianaduranp@gmail.com

Omar Pellon; Mexico City; +52 55 7940 9174; omar.pellon@jdpa.com

Geno Effler; U.S.A.; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info