Dealers and Independent Service Facilities Vying for Half of Service Market in Mexico, J.D. Power Finds

Toyota Ranks Highest in Long-Term Service Satisfaction for Second Consecutive Year

MEXICO CITY: 23 June 2023 — The gap in customer service satisfaction between franchised dealers and independent auto service providers narrows to 28 points (on a 1,000-point scale) this year, according to the J.D. Power 2023 Mexico Customer Service Index—Long-Term (CSI-LT) Study,SM released today. Customer satisfaction with franchised dealers is 872 compared with 844 for independent service facilities. While independent service facilities are closing the gap, they still score lower than franchised dealers in all five factors of the study.

At the same time, 50% of vehicle owners show no loyalty to either authorized dealerships or independent service providers, presenting a marketplace that is up for grabs. These vehicle owners switch between the two service providers, however, dealerships’ percentage of business increased 3 percentage points year over year. Based on the type of service needed, owners show a propensity to visit authorized dealers for more complex work than independent service shops, such as heating/ventilation/air conditioning (11.3% of dealer work); recalls (10.4%); collision repair (6.9%); and audio/entertainment system (5.1%). Owners who switch are choosing to take their vehicle to independent service facilities for more basic wear-and-tear work, such as lube/oil/filter change (65.5%); tire replacement (21.3%); and tire repair (16.2%).

“The service business in Mexico is extremely competitive with both authorized dealers and independent service shops vying for half of the marketplace,” said Gerardo Gomez, senior director and country manager at J.D. Power de Mexico. “While satisfaction is similar among customers of both, customers who aren’t loyal to a particular provider emphasize that dealers and independent service shops must pay close attention to what matters most to get their business. Simple facility improvements or offering a mobile messaging app to schedule service appointments and alert customers of service completion can help with the acquisition and retention of customers.”

As drivers reach pre-pandemic levels commuting in Mexico, the overall service business is shrinking, according to the study. The total amount that customers are spending on servicing their vehicle for the year decreases 27% from a year ago. The reduction in overall spending is influenced by an 11% decrease in the total number of visits to service facilities, declining to 3.17 visits per year vs. 3.41 visits in 2022.

Following are some key findings of the 2023 study:

- Vehicle owners more satisfied when alerted of needed service: A dealership alert informing an owner of an upcoming service improves satisfaction by 28 points when compared with an owner’s learning about service intervals on their own. Owners are most satisfied when proactive dealership service facilities contact them (893) than owners who have to review the factory maintenance schedule to learn when the next service should happen (865). Providing this type of helpful advice is currently only being done 16% of the time by dealerships. “This is a tremendous opportunity for dealerships to reach owners and improve satisfaction levels for their service,” Gomez said.

- Satisfaction improves when scheduling an appointment via an app: Providing an option to schedule a service appointment through a mobile messaging app instead of a phone call can help dealers improve customer satisfaction by 25 points.

- Offering transportation is important: New to the study is the measurement of dealers and independent service providers offering to provide transportation for owners while their vehicle is being serviced. Customers of dealers have satisfaction that is 32 points higher when transportation is offered—but that occurs only 42% of the time. When transportation is offered to customers of independent facilities, satisfaction increases 29 points—but transportation is offered only 27% of the time.

- Areas for satisfaction improvement: When a service advisor is attentive to a customer’s needs—which happens 94% of the time—satisfaction increases 71 points. This key performance indicator (KPI) is the only factor that has appeared in the top 4 KPIs each of the past four years. Other areas for notable satisfaction improvement include offering wireless internet (+49 points); cleaning up the shop (+16) and providing complimentary snacks (+15).

Highest-Ranking Brands

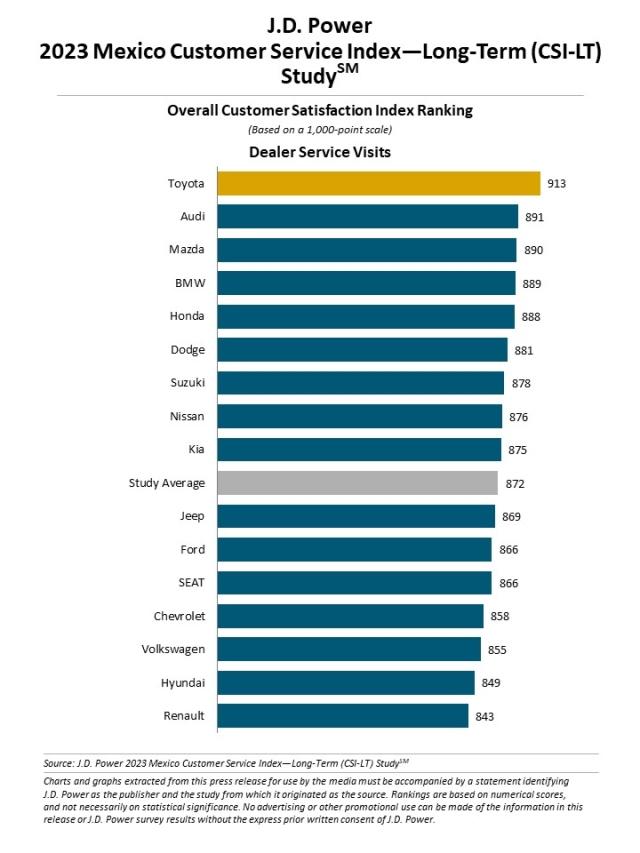

Toyota ranks highest in overall satisfaction among franchised dealers for a second consecutive year with a score of 913. Audi (891) ranks second and Mazda (890) ranks third.

The Mexico Customer Service Index—Long-Term (CSI-LT) Study, now in its fifth year, has been redesigned to hyper-focus on today’s current service experience among owners of three- to 12-year-old vehicles. The study measures satisfaction with service at franchised dealer or aftermarket service facilities for maintenance or repair work among owners and lessees. It evaluates customer satisfaction with their dealer or non-dealer service center by examining five key measures (in order of importance): service quality (33%); vehicle pick-up (19%); service advisor (18%); service initiation (15%); and service facility (14%).

The study is based on the evaluations of 3,409 interviews with new- and used-vehicle owners in Mexico about their three- to 12-year-old vehicles. The study was fielded from October 2022 through February 2023.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://mexico.jdpower.com/.

Media Relations Contacts

Fabiana Duran; Mexico City; +52 55 1012 0885; fabiana@mediaroom.mx

Geno Effler, J.D. Power; U.S.A.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info